Japan’s Sharp announced its strategies to move into the OLED market on Wednesday as the Apple supplier looks to catch rival Samsung Electronics, Reuters reported.

Sharp will offer OLED panels in its new smartphones later this year and plans to sell OLED screens to other manufacturers.

Sharp will offer OLED panels in its new smartphones later this year and plans to sell OLED screens to other manufacturers.

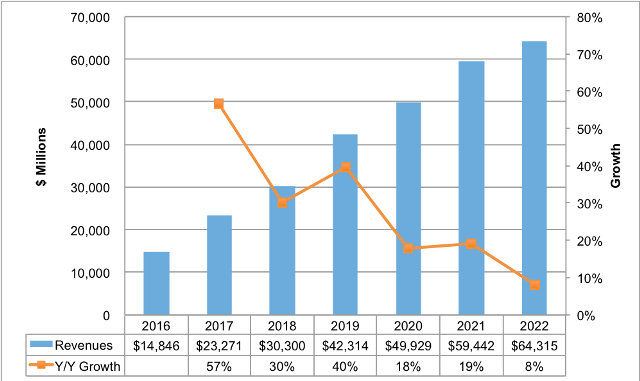

DSCC says OLED shipment will grow at 30 percent to $30.3 billion. The OLED market will be growing at 23 percent CAGR reaching $64.3 billion in 2022 from 2017.

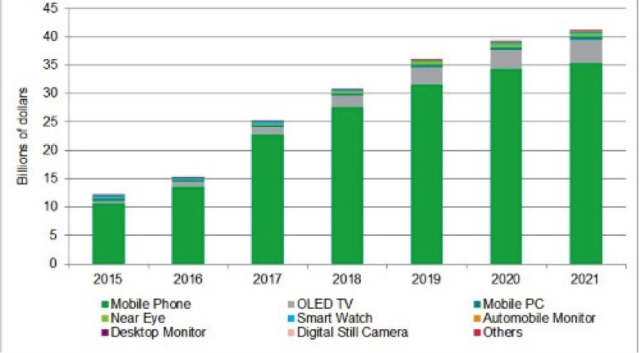

Smartphones are expected to remain the dominant market, accounting for around 91 percent of units per year with the smartphone revenue share falling from 87 percent share in 2018 to 79 percent share in 2022.

OLED smartphones are expected to fall from 64 percent share in 2017 to 50 percent share in 2022.

IHS earlier forecasts that OLED revenues will reach $25.2 billion in 2017, up 63 percent, due to growing use of AMOLED panels in smartphones and TVs.

Sharp has signaled it is wary about a rapid expansion in OLED as momentum for the thinner but more expensive screens slows.

The move comes as the Osaka-based electronics maker, a major supplier of iPhone liquid crystal display (LCD) screens, continues its recovery after being bought two years ago by Taiwan’s Foxconn.

Sharp’s OLED smartphones will initially go on sale in Japan, by far its major market after it slashed its overseas smartphone business. The company has not yet reached any deals for sales to other smartphone makers.

Sharp’s OLED smartphones will initially go on sale in Japan, by far its major market after it slashed its overseas smartphone business. The company has not yet reached any deals for sales to other smartphone makers.

Sharp has invested 57.4 billion yen or $505 million to produce OLED panels in western Japan, less than a third of the planned 200 billion yen investment that was announced by Foxconn at the time of its acquisition in 2016.

Sharp executives have said a shift from conventional LCD screens to more flexible OLED screens has been slower than expected due to high prices, making the firm cautious about aggressive OLED capacity expansion in the near term.

“The momentum for OLED panels is waning compared to a year ago and is unlikely to pick up immediately,” senior Sharp executive Katsuaki Nomura told reporters in July.

The slower acceptance of pricier OLED panels has also offered some relief to Japan Display, another iPhone LCD screen supplier lagging behind Samsung and LG Display in OLED technology.

Japan Display said it may push back the start of OLED commercial production, currently scheduled for 2019, while seeking a partner to help finance the launch of a mass production line. Analysts say it typically costs more than 200 billion yen ($1.8 billion) to start a mass production line.

South Korea’s Electronic Times reported earlier this year that Apple has decided to use OLED screens in all three new iPhone models planned for next year, compared to two OLED models this year.

But industry sources have told Reuters that Apple would not entirely abandon low-cost LCD screens at least for next year.

Still, analysts say the OLED panel market could pick up again if improvements in production efficiency at Korean and Chinese panel makers lead to lower costs. OLED panels offer richer colors than LCDs and allow for foldable phones.