Smartphone shipments in Africa increased 14.1 percent to 22.9 million units during the third quarter of 2020, IDC report said.

Transsion, Samsung, Huawei, Xiaomi and Oppo are the top five smartphone suppliers in the Africa region.

The growth of the smartphone market was caused by the release of pent-up demand after countries eased their COVID-19 lockdown restrictions and by a shift in vendor strategies to offer more entry-level flagship models.

Africa’s overall mobile phone market shipments declined 6 percent in Q3 2020.

Feature phones shipments of declined 11.2 percent in Q3 2020 to total 29.4 million units.

Africa’s largest smartphone markets recorded mixed performances – Egypt and Nigeria both posted growth in Q3 2020, while South Africa suffered a decline.

Smartphone shipments to Nigeria grew due to a shift from vendors to entry-level and mid-range devices.

Similarly, the Egyptian smartphone market grew as vendors offered devices with more competitive prices, larger screens, and improved features.

Despite, experiencing a 13.4 percent decline in shipments, South Africa continued to lead the way in Africa’s smartphone market, with shipments to the country totaling 3.3 million units.

“While South Africa’s smartphone market experienced a decline, shipments actually increased 17.8 percent QoQ as lockdown restrictions were lifted and the channels replenished their inventories for Q4 promotions,” says Arnold Ponela, research analyst at IDC.

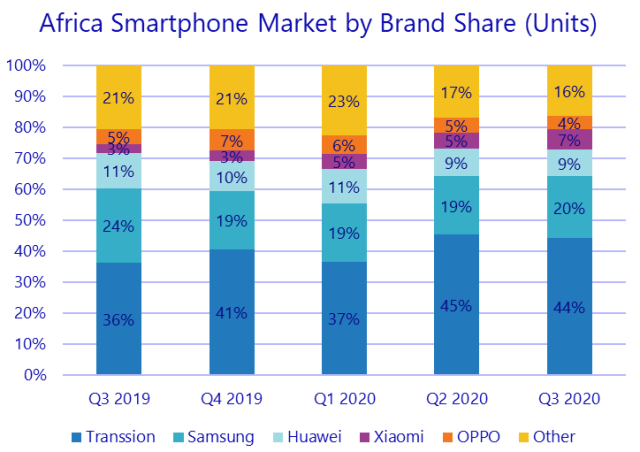

Transsion brands (Tecno, Itel, and Infinix) dominated Africa’s smartphone space in Q3 2020, with 42.2 percent unit share.

Samsung and Huawei followed in second and third place, with respective unit shares of 19.9 percent and 8.7 percent.

The Transsion brands (Tecno and Itel) dominated the feature phone landscape with a combined share of 76.6 percent.

Nokia came in third with 8.0 percent share of feature phone shipments.

IDC expects the recovery in shipments seen in Q3 to continue through Q4 2020 during the festive months, with overall shipments expected to grow 4.6 percent quarter on quarter, Ramazan Yavuz, senior research manager at IDC, said.