The latest IDC report and the report from Strategy Analytics indicate that global smartphone shipments grew substantially during the second quarter of 2021.

Strategy Analytics

Strategy Analytics

Global smartphone shipments grew 11 percent in Q2 2021 to 314.2 million units. This is the second highest annual growth rate (behind Q1 2021’s +28 percent growth rate) recent years. However, smartphone shipment fell 11 percent QoQ, mainly blaming to the second wave of COVID-19 in India and South East Asia countries, as well as the impact of supply constrain.

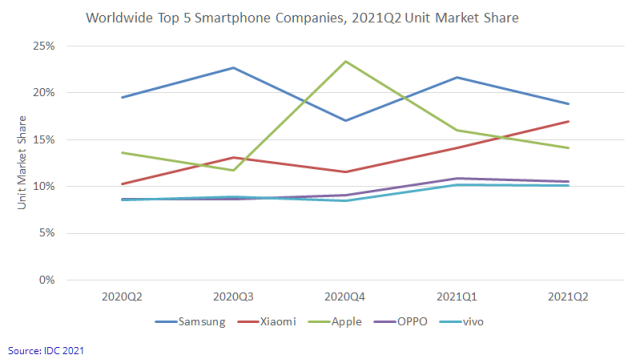

Samsung maintained the #1 position with 18.2 percent share. Samsung has registered the lowest annual growth rate at 5.4 percent. The intensified competition from Chinese vendors and the supply constrain both impacted the performance of Samsung.

Xiaomi jumped into the top 2 list for the first time ever. Xiaomi shipped 52.8 million smartphones in Q2 2021 for 16.8 percent share. Xiaomi seized the opportunities from the withdrawal of LG in Latin America, and Huawei’s fallout in Europe region.

Apple shipped 47.4 million units of iPhones and captured 15.1 percent market share. Emerging markets are playing an increasing role in Apple’s global map. China has overtaken the USA being the largest single market for Apple iPhone, for the first time ever.

Chinese vendor OPPO and vivo took the top five list, with 10.6 percent and 10.0 percent market share respectively this quarter. Both vendors witnessed the double digit annual growth rate, mainly come from China, India and other overseas markets.

IDC

Smartphone shipment volumes grew 13.2 percent to 313.2 million. Every region contributed to the overall growth except for China, where the lack of flagship product launches, poor demand, and the decline of the Huawei brand pulled the market down 10 percent compared to the second quarter of 2020.

Xiaomi moved into the second position for the first time, moving Apple to third.

In the markets where Huawei and LG are strongest (China and the USA, respectively), companies face different chances of gaining that share. In the United States, Motorola, TCL, and OnePlus experienced year-over-year gains beyond what they have seen in recent years due to LG’s departure. In China, Xiaomi, OPPO, vivo, and Apple gained from Huawei’s decline.