Canalys tablet market share report for first quarter of 2014 (Q1 2014) for India indicated decrease in the shipments of Apple and Samsung, while Lenovo, Acer and Asus gained.

Samsung and Apple missed shipment targets mainly to Lenovo in India.

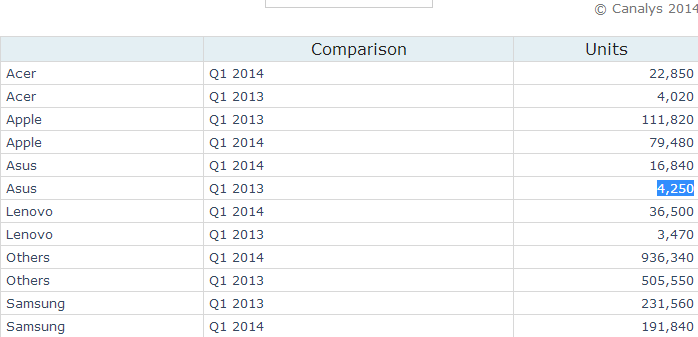

Samsung shipped 191,840 units of tablets in Q1 2014 against 231,560 in Q1 2013.

Apple tablet shipments decreased to 79,480 from 111,820.

On the other hand, Lenovo increased shipments to 36,500 from 3,470

Acer grew its tablet shipments to 22,850 from 4,020.

Asus has shipped 16,840 tablets in Q1 2014 against 4,250 in Q1 2013.

Apple’s decline was mainly due to inventory adjustment in channels. In addition, iPad mini for Rs 21,900 failed to pull enough users in as well.

James Wang of Canalys said Samsung’s decline was seasonal. It was undergoing the transition from 2013 models to 2014 models in the quarter. Comparing to other countries, Samsung’s portfolio in India in Q1 2013 was much more limited, mainly the 7” Galaxy Tab 3.

Lenovo, Acer, and Asus started to have products targeting the mass market in India since H2 2013. So their year-on-year growth looked much higher than other competitors as their shipments in last year were relatively small.

“We believe that Micromax is a competitive tablet vendor in India. It has more understanding of the market than many global vendors and is more responsive to the market changes. We are seeing sub-$150 7” voice tablets growing in India and Micromax is the pioneer in this segment,” James Wang said.

Global tablet market trends

Canalys said growth in worldwide tablet shipments slowed to 21 percent to 50.8 million units. Tablets accounted for 41 percent of the overall PC market.

Middle East tablet market rose 100 percent, Greater China (74 percent) and Central and Eastern Europe (47 percent), and while there was positive growth in all other regions with the exception of North America.

The US market was adversely affected by a drop in Apple iPad shipments, which fell 40 percent. This was offset by 20 percent growth in China, Apple’s second largest market. Worldwide, iPad shipments in Q1 fell 16 percent to 16.4 million.

Unlike Apple, with its one size fits all tablet strategy, Lenovo and others are free to tailor tablets to specific market segments. The tablet form factor is well liked by both young and old consumers; product customization can be beneficial in both cases, said Canalys.

The report noted that HP’s tablets now come with bundled mobile data in a growing number of markets. While other vendors have flirted with this idea, HP’s proposition adds significant value to end users, and will appeal not just to individuals but SMBs as well. The vendor has set itself apart from the low-cost tablet battlefield where many are struggling to compete.

Baburajan K

[email protected]