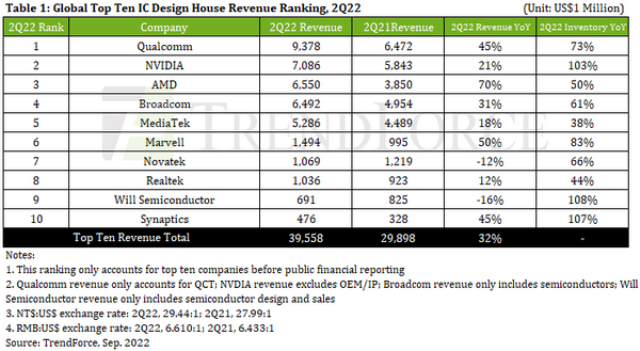

Revenue of the top ten global IC design firms grew 32 percent to $39.56 billion in Q2 2022, according to TrendForce.

Growth was primarily driven by demand for data centers, networking, IoT, and high-end product portfolios.

Growth was primarily driven by demand for data centers, networking, IoT, and high-end product portfolios.

AMD achieved synergy through mergers and acquisitions. In addition to climbing to third place, AMD also posted the highest annual revenue growth rate in 2Q22 at 70 percent.

Qualcomm has retained the No. 1 position, exhibiting growth in the mobile phone, RF front-end, automotive, and IoT sectors. Sales of mid/low-end mobile phone APs were weak but demand for high-end mobile phone APs was stable. Qualcomm revenue rose 45 percent to $9.38 billion.

NVIDIA benefitted from expanded application of GPUs in data centers to expand this product category’s revenue share to 53.5 percent, making up for the 13 percent slump in its game application business, bringing total revenue to $7.09 billion, though annual growth rate slowed to 21 percent.

AMD reorganized its business after the addition of Xilinx and Pensando. AMD’s embedded division revenue increased 2,228 percent. In addition, AMD’s data center department also made a considerable contribution. AMD revenue rose 70 percent to $6.55 billion.

Broadcom’s sales performance in semiconductor solutions remained solid and demand for cloud services, data centers, and networking is quite strong. Broadcom’s revenue rose 31 percent to $6.49 billion.

MediaTek revenue rose 18 percent to $5.29 billion as it maintained growth in the mobile phone, smart edge, and power IC sectors, but was stifled by sluggish sales of Chinese-branded mobile phones during Q2 2022.

Novatek, whose products mainly consist of display driver ICs, was impacted by declining demand for panels and consumer products. Novatek revenue fell 12 percent to $1.07 billion.

Realtek’s networking product portfolio performed well, Wi-Fi demand remained stable. Realtek was affected by weakness in the consumer and computer markets. Realtek revenue fell 12 percent to $1.04 billion.

Marvell’s revenue increased 50 percent to $1.49 billion as its data center product expansion was successful.

TrendForce indicates IC design houses will have difficulties maintaining revenue growth due to a high preceding base period and poor market conditions. Consumer IC products also need several quarters to regulate day sales of inventory and carry out destocking.