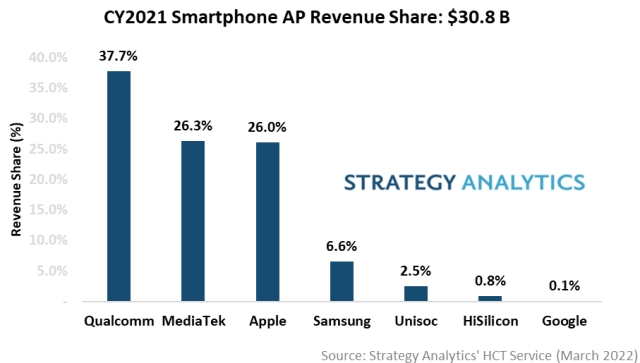

The global smartphone applications processor (AP) market grew 23 percent to $30.8 billion in 2021, according to Strategy Analytics report.

Qualcomm has 38 percent revenue share in the smartphone processor market.

Qualcomm has 38 percent revenue share in the smartphone processor market.

MediaTek has 26 percent share in the smartphone processor market.

Apple has 26 percent share in the smartphone processor market.

Apple, MediaTek, Qualcomm and Unisoc gained share in the smartphone processor market.

HiSilicon and Samsung LSI lost share in the smartphone processor market.

5G-attached AP shipments grew 84 percent, accounting for 46 percent of total smartphone APs shipped in 2021.

Shipments of APs with on-device artificial intelligence (AI) engines crossed 900 million in 2021, roughly flat compared to 2020. However, increased shipments of mid-range APs without AI engines limited the growth.

Top-selling Android AI APs include Snapdragon 888/888+, 765/G, 750G and 662 and Dimensity 700.

TSMC manufactured three in four smartphone APs shipped in 2021.

Semiconductor foundries, including TSMC and Samsung Foundry, held up well despite supply constraints and helped the industry capture growth.

Smartphone APs manufactured in 7 nm and below process technologies accounted for 43 percent of total smartphone AP shipments in 2021.

Google entered the smartphone AP market in 2021 with its Pixel Tensor chip, capturing approximately 0.1 percent unit and revenue share.

MediaTek overtook Qualcomm in units and established over 75 million unit-lead in smartphone APs 2021.

MediaTek capitalized on Qualcomm’s defocus on mid and low tier 4G LTE APs and gained volume share.

Qualcomm exited 2021 with over 43 percent higher revenue than MediaTek, thanks to an increased mix of higher-priced premium and high-tier APs.

Both Qualcomm and MediaTek performed well in the 5G AP segment and posted a 13-year high in their AP average selling prices (ASPs).

Strategy Analytics said Unisoc has the potential to take LTE AP share from MediaTek in 2022 as the latter shifts its focus to 5G.

Samsung LSI saw a sharp decline in its AP shipments as its primary customer Samsung Mobile shifted orders to Qualcomm, MediaTek and Unisoc.

Samsung shipped less than 100 million APs in 2021. Samsung could regain market share with its new Exynos 1280 mid-range 5G AP in 2022.