Qualcomm CEO Steve Mollenkopf revealed that Huawei Technologies’s strong gains in the China smartphone market will be negatively impacting the company’s chipset business in the coming quarters.

Qualcomm reported revenue of $4.9 billion – excluding Apple settlement amount — for the third quarter ended June 30. Qualcomm has provided revenue guidance of $4.3-$5.1 billion in the next quarter.

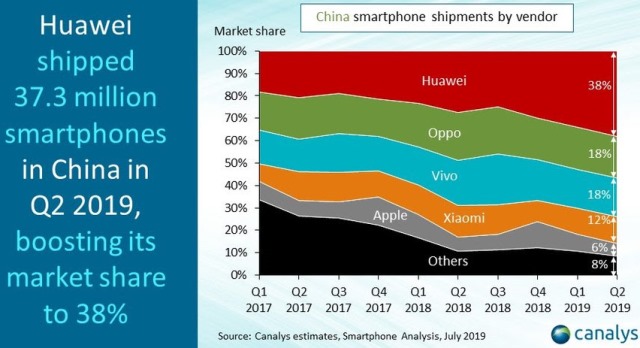

Qualcomm CEO said Huawei has grabbed smartphone market share in China mainly from its customers such as Xiaomi, Oppo and Vivo in China. Qualcomm does not supply chipset to Huawei at present due to trade disputes.

“Huawei’s advance has spurred other phone makers to cancel 4G smartphone models planned for the rest of this year and instead focus on 5G models for release early next year that could drive growth for Qualcomm, Steve Mollenkopf said.

Huawei surged ahead in China in Q2 2019 to achieve the highest market share for any vendor in eight years. Huawei grew 31 percent on the back of shipping 37.3 million units, research firm Canalys said.

Huawei’s major smartphone competitors such as Oppo dipped 18 percent after shipping 17.9 million units, Vivo down 19 percent with 17.1 million units, Xiaomi fell 20 percent with 11.5 million units, and Apple dropped 14 percent with 5.7 million units, Canalys said.

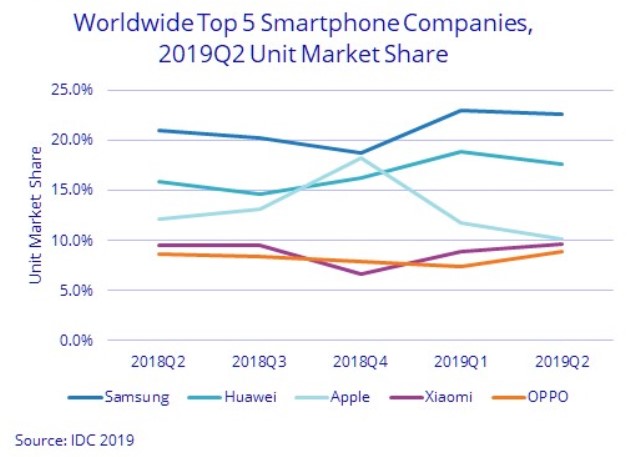

The latest IDC report said Huawei’s global smartphone shipment volumes fell 0.6 percent in Q2 when compared to Q1. Huawei’s smartphone shipment volumes in China hit an all-time high and accounted for 62 percent of Huawei’s Q2 total with 36.4 million units.

Though Qualcomm customers such as Oppo, Vivo and Xiaomi have started focusing on 5G business, Qualcomm will not see benefits from that shift until early 2020. Qualcomm’s business will be impacted due to the cancellation of 4G smartphone launches by its existing customers.

Huawei’s effect on Qualcomm’s forecast underscores the extent to which the Chinese company has become more of a rival than a customer to the San Diego-based company. Huawei, which was the subject of U.S. sales restrictions imposed in May, continues to buy a small number of Qualcomm chips, Reuters reproted.

Mollenkopf said the U.S.-China trade war and a slow smartphone market drove Qualcomm to lower its outlook for 2019 sales of smart devices to a range of 1.7 billion to 1.8 billion, down from a previous estimate of 1.8 billion to 1.9 billion.

Apple last week bought Intel’s modem business in $1 billion deal to help supply its own smartphone chips. The world’s largest chipset maker said Apple’s purchase will have no effect on Qualcomm’s fourth quarter outlook.