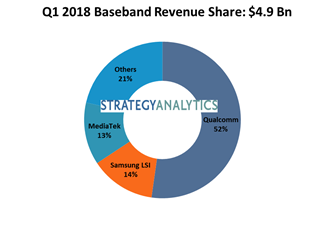

The cellular baseband processor market grew 0.3 percent to $4.9 billion in the first quarter Q1 2018, according to Strategy Analytics.

Qualcomm, Samsung LSI, MediaTek, HiSilicon and UNISOC (Spreadtrum & RDA) captured the top-five revenue share rankings in the global cellular baseband processor market in Q1 2018.

Qualcomm has 52 percent share in cellular baseband processor market.

Samsung LSI has 14 percent share in cellular baseband processor market.

MediaTek has 13 percent share in cellular baseband processor market.

The LTE baseband shipment grew 9 percent in Q1 2018, while the 2G and 3G baseband segments posted double-digit declines.

MediaTek and UNISOC (Spreadtrum & RDA) lost market share.

Altair, HiSilicon, Intel, Qualcomm, Sequans and Samsung LSI all grew baseband shipments year-over-year in Q1 2018.

Samsung LSI, a beneficiary of the 3G to 4G transition, overtook MediaTek in Q1 2018 to propel to the number two revenue share position in the baseband market.

Samsung LSI’s LTE baseband technology, product portfolio and integration capabilities are now in the same league as the market leader Qualcomm.

Samsung LSI has not made any significant wins outside its in-house customer Samsung Mobile.

“The current trade wars have opened a rare window of opportunity to Samsung LSI, as a South Korean company to compete for external baseband customers and it remains to be seen how the company will respond,” Sravan Kundojjala, associate director of Strategy Analytics, said.

MediaTek and UNISOC (Spreadtrum & RDA) lost market share for the fourth consecutive quarter.

MediaTek showed signs of recovery in late Q1 2018 and is on track to perform better though the rest of 2018 with the help of an improved product portfolio.

UNISOC (Spreadtrum & RDA), despite gains in LTE feature phones, lagged the competition in terms of product strength.

“Both MediaTek and UNISOC (Spreadtrum & RDA) need to address the weakness in their modem product portfolio and claim their stake in 5G to enable the company to match fast moving Qualcomm,” Stuart Robinson, executive director of Strategy Analytics, said.

For the third consecutive quarter, Qualcomm saw its shipments grew year-over-year in Q1 2018, thanks to the company’s share gains at Chinese handset manufacturers.

“Qualcomm is set to repeat the feat in 5G New Radio (NR) market,” Christopher Taylor, director of Strategy Analytics, said.

Strategy Analytics estimates that non-handset baseband segments accounted for 10 percent of Qualcomm’s total baseband shipments in Q1 2018 registering faster growth than the handset segment.