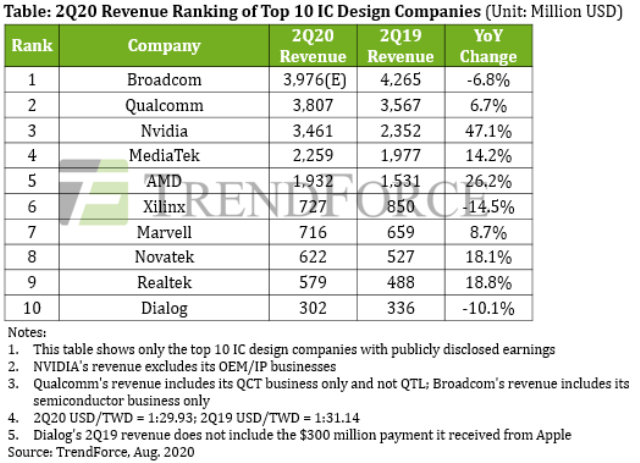

Research firm TrendForce has revealed revenue ranking of top ten IC design companies for Q2 2020.

Broadcom has captured the number one position by surpassing Qualcomm in quarterly revenue.

Broadcom has captured the number one position by surpassing Qualcomm in quarterly revenue.

Despite demand for 5G products driven by WFH and distance education needs, Qualcomm’s upward momentum in 2Q20 was constrained due to the delayed release of Apple’s latest iPhones, according to TrendForce analyst CY Yao.

New product releases by Apple during third quarters had typically contributed to Qualcomm’s second quarter revenues in the past. Delayed iPhone releases this year, however, led to a slowdown in Qualcomm’s chip revenue growth. Qualcomm has clocked 6.7 percent revenue growth in Q2.

Though Broadcom regained first place, escalating tensions between China and the U.S. had a negative effect on its semiconductor revenue performance. Broadcom’s semiconductor revenue declined 6.8 percent in Q2.

Nvidia includes revenue from Mellanox as part of its data center revenue after the acquisition earlier this year. The addition of Mellanox was able to compensate for Nvidia’s shortfall in professional visualization and automotive revenue. Nvidia increased its revenue by 47.1 percent.

AMD’s semiconductor revenue rose 26.2 percent due to the outstanding receptions of its Ryzen and EPYC processors in the notebook and server markets, respectively.

Xilinx’s wired and wireless network equipment market posted 33.2 percent dip in quarterly revenue, and the COVID-19 pandemic took a heavy toll on the global automotive market, leading to a decline in Xilinx’s automotive revenue.

Dialog saw decreased revenue from its custom mixed-signal IC, leading to a decrease of 10.1 percent in Q2 revenue.

In the face of escalating sanctions by the U.S. Department of Commerce, Huawei subsidiary HiSilicon is unlikely to fulfill chip demand from Huawei’s various product lines. HiSilicon’s new Kirin processors to be released in 2H20 is expected to be the final mobile processor released by the company.

MediaTek and Realtek maintained their excellent performances during the quarter, reaching revenue growths of 14.2 percent and 18.8 percent, respectively.

MediaTek was able to successfully deploy its products to the 5G mid-range smartphone market with its 7nm process technology and cost optimization measures, in turn raising its revenue and gross margins.