Cisco’s 2 percent drop in revenue to $11.6 billion in Q2 fiscal 2017 – a 4 percent dip in product revenue and 5 percent up in service revenue – indicates need for more innovation.

Cisco’s 2 percent drop in revenue to $11.6 billion in Q2 fiscal 2017 – a 4 percent dip in product revenue and 5 percent up in service revenue – indicates need for more innovation.

Cisco could not grow its revenue in all geographies. Revenue of Cisco Systems’ fell 3 percent in America to $6,660 million, flat in EMEA to $3,065 million and dipped 3 percent in Asia Pacific to $1,855 million.

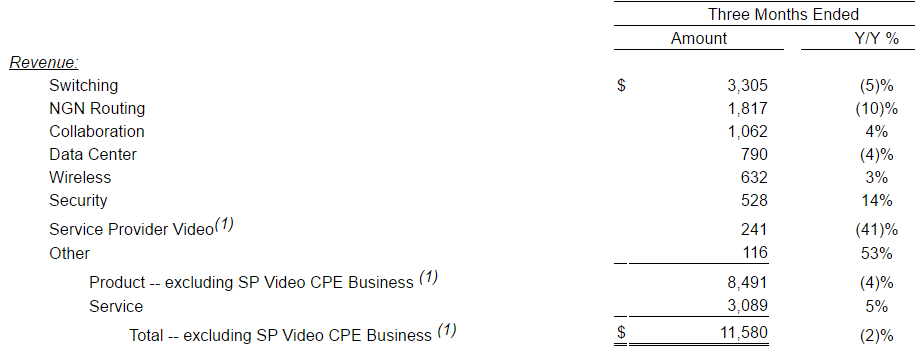

Cisco said its product revenue dropped to $8,491 million (–4 percent), while service revenue rose to $3,089 million (+5 percent).

Cisco Services contributes 26.7 percent of Cisco revenues, improving 200 basis points from 24.7 percent, driven by innovation to develop security portfolio offerings as well as acceleration of its partnership with Ericsson, according to Kelly Lesiczka, research analyst at Technology Business Review.

Cisco services gross margin was 67.7 percent, improving 210 basis points as the company drove productivity and cost-reduction initiatives.

Cisco shows balanced revenue growth

Cisco’s revenue from main segments did not grow. For instance, Cisco’s revenue from Switching was $3,305 million (–5 percent), NGN Routing $1,817 million (–10 percent), Data Center $790 million (–4 percent).

Cisco grew revenue in Collaboration $1,062 million (+4 percent), Wireless $632 million (+3 percent), and Security $528 million (+14 percent). The exited business Service Provider Video generated $241 million (–41 percent).

“We are pleased with the quarter and the continued customer momentum as we help them drive security, automation and intelligence across the network and into the cloud,” said Chuck Robbins, CEO of Cisco. “We will remain focused on accelerating innovation across our portfolio as we continue to deliver value to customers.”

TBR said expanding resources and increasing awareness of next-generation capabilities enable Cisco to expand revenue in the APJC region.

The report said Cisco continues to strengthen its relationships with government agencies in Asia Pacific, Japan and China (APJC). Cisco has a smart city engagement with the Guangdong Province in China and digital transformation engagement with the Maharashtra Government in India. While APJC is Cisco Services’ smallest geography and accounted for 14.6 percent of services revenue in 2016 it grew 15.9 percent outpacing growth in the Americas and EMEA.

Cisco may acquire more

While Cisco is partially offsetting its weaker ICT business by making software– and– cloud- based acquisitions, Cisco is likely to sustain or even accelerate its M&A cadence. Cisco is well-positioned to make additional acquisitions due to more than $70 billion in cash and short-term investments, and which would become easier if a Trump administration eases one-time cash repatriation penalties, according to Patrick Filkins, analyst at TBR.

TBR indicates that the global ICT hardware market is expected to contract over the long-term, mainly due to disruption from NFV and SDN. Hence, Cisco will do M&A with cost-cutting initiatives, such as layoffs and the discontinuation of non-strategic programs, such as Intercloud.

Cisco to stop Intercloud in March 2017

Cisco will stop Intercloud in March 2017, signaling the end to a $1+ billion program which launched in 2014. Intercloud was an alternative cloud service delivery model to large cloud providers, such as Amazon Web Services (AWS) and Microsoft.

Instead, Cisco will refocus on building and managing hybrid IT infrastructure, more in line with its traditional role as a components supplier. The strategy of Cisco move is necessary as AWS, Microsoft, Google and other large cloud providers accrue a leading share of the public cloud market, nullifying the demand for Intercloud.

Baburajan K

[email protected]