Telecom software and network maker Ericsson has posted 10 percent drop in revenue in 2016 to SEK 222.6 billion or $25.10 billion.

Telecom software and network maker Ericsson has posted 10 percent drop in revenue in 2016 to SEK 222.6 billion or $25.10 billion.

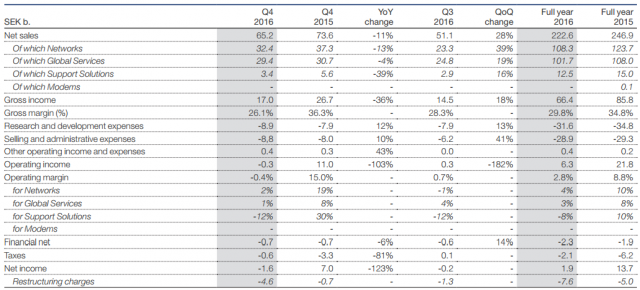

Ericsson’s fourth quarter revenue fell 11 percent to SEK 65.2 billion or $7.34 billion.

Ericsson generated SEK 32.4 billion from networks business, SEK 29.4 billion from global services and SEK 3.4 billion from support solutions in Q4 2016.

Patrick Filkins, analyst at TBR, said a slow adjustment to contracting capital expenditure (Capex) negatively affected Ericsson’s revenue and profits.

ALSO READ: Ericsson 2016 revenue analysis by TBR

Ericsson has sustained heavy revenue declines and operating income losses due to lower Capex outlays pressure results. Revenue declined 11.4 percent while operating margin was -0.4 percent, negatively affected by higher than expected restructuring costs and a drop in sales to North America-based telecom operators.

Ericsson says the telecom market conditions will continue in 2017 as well.

ALSO READ: Ericsson CEO Borje Ekholm on 2016 revenue performance

Why Ericsson’s revenue dropped

While cost cutting is likely to be top of mind in the coming months, Ericsson’s targeted growth areas (IP, Cloud, OSS/BSS and Media) have yet to generate the revenue required to offset lower LTE RAN sales, according to TBR analyst.

Support Solutions, which contains Ericsson’s OSS/BSS and Media sales, declined 39.5 percent — due to lower legacy sales and large mergers by customers, which reduced Ericsson’s addressable market and revenue opportunities.

Ericsson said sales decreased mainly due to weaker demand for mobile broadband, especially in markets with a weak macroeconomic environment. IPR licensing revenues declined to SEK 10 billion from 14.4 billion.

Operating income of Ericsson declined to SEK 6.3 billion from 21.8 billion due to lower sales and a changed business mix in mobile broadband, with a lower proportion of capacity business. This was partly offset by lower operating expenses.

Profitability of Ericsson declined following lower IPR licensing revenues mainly due to last year’s agreement with Apple as well as increased restructuring charges.

Segment Networks sales increased by 39 percent. The new radio platform, Ericsson Radio System (ERS), represented almost 15 percent of total deliveries of radio units for 2016 and the roll-out of the new platform is gradually ramping up.

Global Services sales declined 4 percent due to the reduced scope of a managed services contract in North America. Support Solutions sales declined 39 percent, due to lower IPR licensing revenues. In addition, TV & Media sales were lower than expected due to a rapid decline in legacy products.

Sales in the targeted areas declined 7 percent, impacted by lower sales in OSS and BSS following the transition from legacy to new products.

Ericsson’s future

Ericsson is allocating resources into digital transformation projects to secure important deliveries in 2017.

According to TBR, due to anticipated dip in operator Capex until commercial, standards-based 5G implementations occur in 2020, RAN suppliers are likely to see revenue and margins contract in 2017.

While revenues will remain challenged until the 5G air interface standards are finalized, suppliers are constructing 5G road maps, with the goal of pulling revenue ahead by tethering NFV, SDN, cloud and LTE enhancements to forthcoming 5G implementations.

Ericsson at present does not have a strong revival plan in place. Nokia, the main rival of Ericsson, will announce its earnings on February 2.

Baburajan K

[email protected]