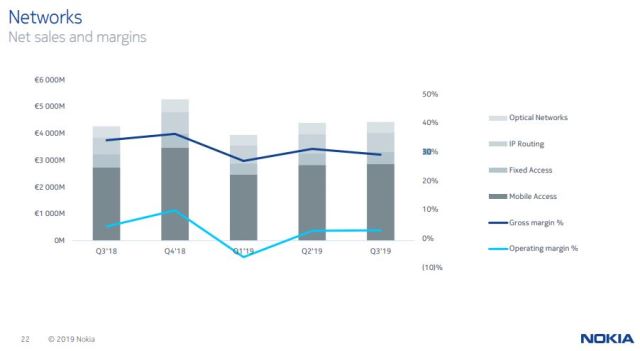

Nokia has reported 1 percent growth in its Networks business during the third quarter of 2019.

Nokia has generated revenue of 2.861 billion euros (+1 percent) from Mobile Access, 466 million euros (–10 percent) from Fixed Access, 716 million euros (+13 percent) from IP Routing and 390 million euros (–8) percent from Optical Networks business.

Nokia has generated revenue of 2.861 billion euros (+1 percent) from Mobile Access, 466 million euros (–10 percent) from Fixed Access, 716 million euros (+13 percent) from IP Routing and 390 million euros (–8) percent from Optical Networks business.

Nokia was behind the 15 5G networks that went live. Nokia’s 5G customers include Sprint, Verizon, AT&T and T-Mobile in the US; Vodafone Italy and Zain in Saudi Arabia; as well as SK Telecom, KT and LGU+ in Korea.

Nokia said the marginal growth in Networks business was primarily due to Mobile Access and IP Routing, partially offset by Fixed Access and Optical Networks. The growth in Mobile Access was primarily due to 5G radio technologies and network deployment services, partially offset by decreases in legacy radio technologies.

Mobile Access sales were negatively affected by temporary capital expenditure constraints in North America related to customer merger activity, as well as continued competitive pressure in Greater China.

The growth in IP Routing was primarily due to portfolio and supply chain execution. The dip in Fixed Access was primarily due to a shift in capital expenditures away from fixed access and towards 5G wireless access.

The decrease in Networks gross profit was primarily due to Mobile Access and, to a lesser extent, Fixed Access and Optical Networks, partially offset by IP Routing. The decrease in Mobile Access gross profit was primarily due to lower gross margin, partially offset by higher net sales.

The decrease in Fixed Access gross profit was due to lower gross margin and lower net sales. The decrease in Optical Networks gross profit was primarily due to lower net sales. The increase in IP Routing gross profit was due to higher net sales and higher gross margin. Nokia’s Networks gross profit benefitted from lower incentive accruals. The lower gross margin in Mobile Access was primarily due to relatively high 5G product costs, as well as elevated levels of deployment services, consistent with being in the initial phase of 5G.

Nokia experienced broad-based gross margin declines across most product categories in Q3 2019, partially offset by improvements across most services categories driven by strengthened operational execution, with a focus on cost discipline and initiatives to improve service delivery digitalization and automation.

The lower gross margin in Fixed Access was primarily due to broadband access and digital home. The higher gross margin in IP Routing was primarily due to our market -leading portfolio. The decrease in Networks R&D expenses was primarily due to continued progress related to Nokia’s cost savings program, partially offset by higher 5G investments in Mobile Access.