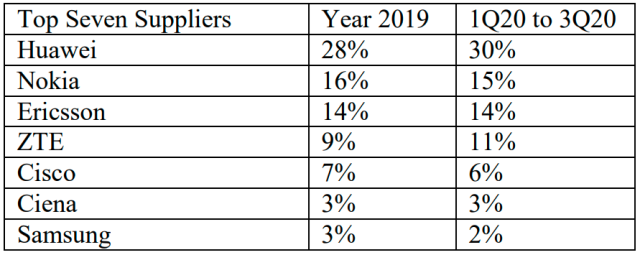

Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung are the top seven telecom network suppliers during the first three quarters of 2020.

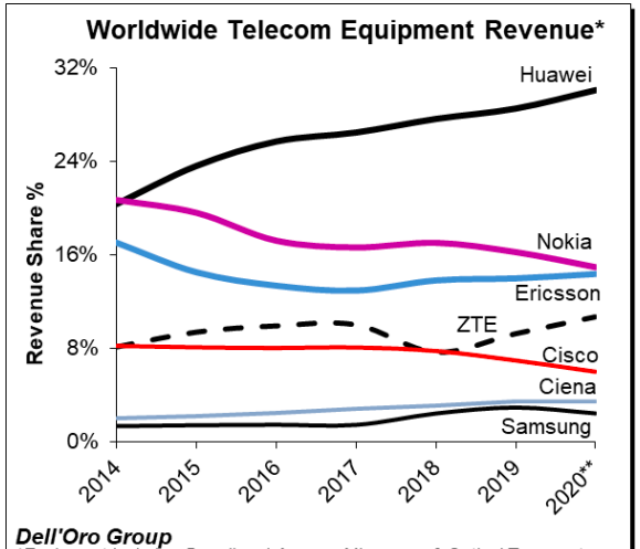

The latest report from Dell’Oro Group indicates that Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung have retained their respective share in the global telecom network business.

Huawei could increase the share thanks to its 5G network wins in China. Huawei has hiked its share to 30 percent during the first nine months of 2020 from 28 percent in 2019.

The network share of Nokia fell to 15 percent during the first nine months of 2020 from 14 percent in 2019.

Ericsson could retain its telecom network equipment share at 14 percent during the first nine months of 2020 from 14 percent in 2019.

ZTE has increased its share to 11 percent during the first nine months of 2020 from 9 percent in 2019.

The telecom network share of Cisco fell to 6 percent during the first nine months of 2020 from 7 percent in 2019.

The telecom network share of Ciena was stable at 3 percent during the first nine months of 2020 as compared with 3 percent in 2019.

The telecom network share of Samsung was stable at 3 percent in the first nine months of 2020 as compared with 3 percent in 2019.

The development assumes significance for Huawei because the China-based telecom network vendor is facing strict security-related scrutiny in several global markets. Huawei lost considerable share in the US market.

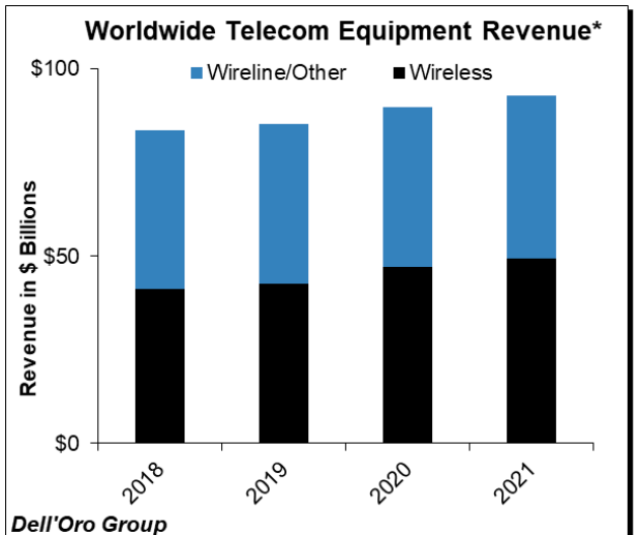

The overall telecom equipment market – Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & Carrier Ethernet Switch (CES) – advanced 9 percent Year-Over-Year Y-Y during 3Q20 and 5 percent Y-Y for the 1Q20-3Q20 period.

Preliminary estimates indicate increasing Mobile Infrastructure and Optical Transport revenues offset declining investments in Microwave Transport and SP Routers & CES for the 1Q20-3Q20 period.

The overall telecom equipment market continued to appear disconnected from the underlying economy. While the on-going transition from 4G to 5G is helping to offset reduced Capex in slower-to-adopt mobile broadband markets, we also attribute the disconnect to the growing importance of connectivity and the nature of this recession being different than in other downturns improving the visibility for the operators.

Huawei and ZTE collectively gained about 3 percentage points of revenue share between 2019 and 1Q20-3Q20, together comprising more than 40 percent of the global telecom equipment market. Huawei and ZTE achieved more share thanks to investments in China that outpaced the overall teleocm equipment market.

Huawei and ZTE collectively gained about 3 percentage points of revenue share between 2019 and 1Q20-3Q20, together comprising more than 40 percent of the global telecom equipment market. Huawei and ZTE achieved more share thanks to investments in China that outpaced the overall teleocm equipment market.

The Dell’Oro analyst team has not made any material changes to the overall outlook and projects the total telecom equipment market to advance 5 percent to 6 percent in 2020 and 3 percent to 4 percent in 2021. Total telecom equipment revenues are projected to approach $90 billion to $95 billion in 2021, Stefan Pongratz at Dell’Oro Group said.

Baburajan Kizhakedath