China-based telecom equipment maker Huawei is facing slow revenue growth this year due to cut in Capex by China Mobile, China Unicom and China Telecom.

China-based telecom equipment maker Huawei is facing slow revenue growth this year due to cut in Capex by China Mobile, China Unicom and China Telecom.

Huawei will also be impacted by reduction in Capex by telecom operators in other telecom markets, said a report by TBR.

Top telecom vendors

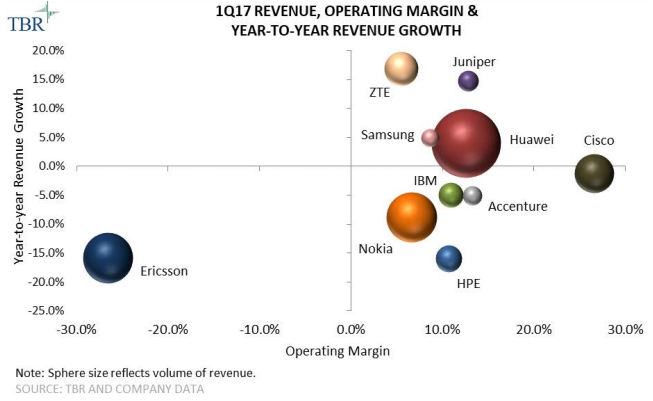

Analyzing the revenue of Huawei, Ericsson and Nokia in 2016, Huawei will retain its top position in the global telecom technology business.

Top technology vendors in carrier business in 2016 were Huawei with $42.16 billion, Ericsson with $24.93 billion and Nokia Networks with $23.27 billion revenue.

Huawei generated revenue of CNY 290,561 million or $42.16 billion from carrier business in 2016.

Ericsson reported SEK 222.6 billion revenue or $24.93 billion from telecomm networks, IoT and cloud and media business last year. Recently, Ericsson restructured its business to focus more on carrier networks and IT.

Nokia Networks business generated revenue of EUR 21,799 million or $23.27 billion in 2016.

Huawei struggles

Due to significant cut in the Capex by China Mobile, China Telecom and China Unicom, Huawei’s telecom business started struggling. China is the main contributor to Huawei’s revenues. Huawei faces tough market conditions in matured telecom markets such as the US and UK. Huawei in the last 12 months did not announce any single deal in India where LTE expansion is happening at a faster pace.

“Huawei has been able to stave off the issues facing the ICT ecosystem, such as how to navigate the technology disruption caused by the shift to software-mediated (NFV, SDN) networks and cloud as well as how to transform operations and business models to align with new market demands, but it will not be able to completely avoid them,” said TBR telecom senior analyst Chris Antlitz.

With CSP Capex spend in China expected to decrease over 13 percent in 2017 and a declining CSP spend environment in international markets, Huawei will find itself at a crossroads in 2017.

Growth of Huawei will likely slow substantially compared to prior years and margins will come under pressure. Huawei will make difficult decisions, including undertaking a restructuring to protect and extend its market leadership.

Huawei, amid a multiyear run of double-digit revenue growth, will not be immune to the trends. “The Chinese company’s growth will likely slow substantially compared to prior years and margins will come under further pressure, which could prompt Huawei to pursue restructuring,” said TBR telecom analyst Michael Soper.

Ericsson is undertaking such an initiative under new CEO Borje Ekholm, but the company faces a difficult road back to market and technology leadership.

ZTE outperformed the market due to favorable payment timing from its core China-based customers, but this represents a temporary reprieve.

Telecom operator spend in CALA is expected to bottom in 2017 and recover in 2018. The awarding of the Red Compartida contract in Mexico by ALTAN Redes, which was jointly won by Nokia and Huawei, represents a key growth driver for the region.

Telecom operator spend in CALA is expected to bottom in 2017 and recover in 2018. The awarding of the Red Compartida contract in Mexico by ALTAN Redes, which was jointly won by Nokia and Huawei, represents a key growth driver for the region.

Telecom operators elsewhere in CALA are also likely to double down on LTE deployments as new spectrum comes to market and the impact of currency devaluations and other economics issues subside.

Vendors under pressure

Legacy infrastructure decommissioning; technology disruption from NFV, SDN and cloud; and business model disruption from digitalization and new consumption models will pose significant headwinds for equipment vendors, said TBR.

“Global spend on ICT infrastructure in the telecom industry is forecast to decline until standards-based 5G arrives in 2020,” said TBR telecom analyst Michael Soper.

In the interim, telecom vendors will emphasize diversification into adjacent customer segments such as the cloud service provider (webscale) space and cable segment, where spend is growing, to offset the impact of lower spend by telecom operators.

Telecom technology vendors will target engagements with top cloud service providers — Microsoft, Google, Facebook, Amazon, Alibaba, Baidu and Tencent – mainly in the United States and China, to drive new revenue opportunities.

Telecom Infrastructure Services

Telecom Infrastructure Services (TIS) vendors are pursuing one of two strategies to weather the impact of lower telecom operator spend, according to TBR.

The first strategy is to expand the portfolio and enter new growth areas, while the second strategy is to refine the portfolio and focus on profit optimization.

“Technology vendors are diversifying their customer bases and portfolios to limit the fallout from lower telecom operator spend. Spend in the cloud service provider and cable customer segments remains robust, while opportunities in the application layer remain attractive across all customer types,” said TBR telecom senior analyst Chris Antlitz.

Nokia and Juniper Networks are standout out-performers in diversification. Nokia is building a strong base of contracts with a diverse range of customers, which should begin to bring organic revenue growth over the next year.

Juniper Networks’ Contrail solution and switching infrastructure for cloud environments remain in strong demand across all customer types.

All telecom vendors including Huawei are awaiting business opportunities from 5G and related IoT services. Actual investment — though small — in 5G networks will start happening towards 2019.

Baburajan K