Telecom network vendors such as Huawei, Samsung, Ericsson, Nokia and ZTE are facing supply chain issues in the wake of COVID-19 epidemic.

Access to some cell sites have become an issue as social distancing measures intensified, according to TBR.

Local governments that approve new cell sites are operating at less-than-full capacity, resulting in permitting delays that could hamper 5G network rollouts, especially in the U.S. Vendors’ ability to meet demand could be in jeopardy if countries shut down much of their economies for an extended period.

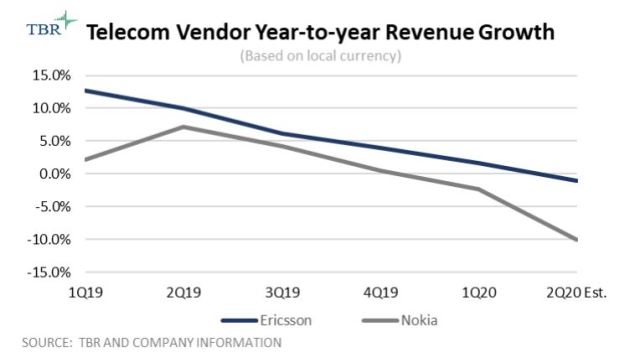

Delays in 5G deployments by operators not currently rolling out the technology will have the largest impact on future earnings for RAN vendors. This issue will be most pronounced in Europe as governments delay spectrum auctions and operators conserve cash.

Ericsson has been pressuring European CSPs and governments for years to accelerate their timelines for 5G to little avail, and the company is now encouraging governments to prioritize 5G investment to restart economic activity.

The COVID-19 pandemic will have a significant effect on the telecom infrastructure services (TIS) market. The ICT infrastructure supply chain is being disrupted by factory shutdowns and furloughs related to virus containment efforts, which could hinder the availability of components for 5G RAN and optical equipment.

Logistical challenges will also arise as engineers and installation teams could face restrictions on their movements and/or access to cell sites, in addition to health concerns. TBR expects the virus to cause spending delays in 2020 and a portion of 2021.

By mid-2021 the supply chain will be fully operational again, at which time the industry will attempt to catch up to align with pent-up demand. CSPs will be key beneficiaries of this addressable market to support government and business initiatives in these areas.

Despite the negative impact from COVID-19, the deployment market will grow through the 5G build cycle as investment occurs not only in the access layer but also in backhaul and the core network.

Equipment installation services will remain in demand despite COVID-19-related challenges, such as rolling out personnel to sites to install new equipment amid the pandemic. Telecom operators still need to deploy small cells, predominantly in urban markets and public venues, that leverage high-band spectrum, and additional macros in the field, primarily on existing sites.

In maintenance services, legacy decommissioning is pressuring the market, with operators retiring technologies including copper access, 2G, 3G, SONET/SDH, ATM and TDM switches. However, the COVID-19 could stall decommissioning efforts in some markets, especially those relied on for voice services.

The pandemic will help spur an accelerated shift to remote support as vendors automate service delivery to reduce field headcount under challenging financial circumstances. On-site tech support is costly due to the high labor costs associated with providing these services.