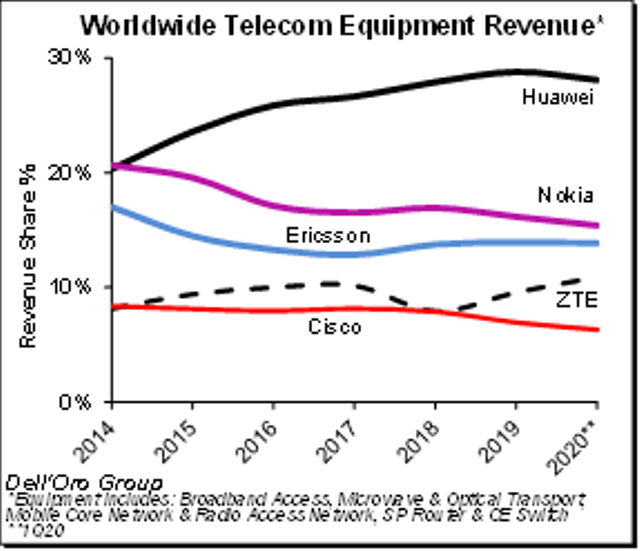

The overall telecom equipment market declined 4 percent during the first quarter of 2020, says Stefan Pongratz, VP and analyst at Dell’Oro Group.

The main components of telecom equipment market include Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & CE Switch.

The main components of telecom equipment market include Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & CE Switch.

Dell’Oro forecasts that the overall telecom equipment market will achieve 1 percent growth in 2020 as compared with the previous forecast of 2 percent growth. The worldwide telecom equipment market revenue grew in both 2018 and 2019 supported by investment in 4G and fiber roll outs.

Ericsson shines

Sweden-based Ericsson, the third largest telecom network supplier, was the shining star by achieving stable revenue growth. Huawei, Nokia, ZTE and Cisco lost share in the first quarter of 2020 as compared with the full year of 2019.

Telecom equipment market share of Huawei reached 28 percent in Q1 2020 as compared with 29 percent in 2019.

Nokia’s telecom equipment market share was 15 percent in Q1 2020 as against 16 percent in 2019.

Telecom equipment market share of Ericsson was 14 percent in Q1 2020 as against 14 percent in 2019.

ZTE’s telecom equipment market share was 11 percent in Q1 2020 as against 10 percent in 2019.

Telecom equipment market share of Cisco was 6 percent in Q1 2020 as compared with 7 percent in 2019.

Market Analysis

The telecom equipment market started the year on a weaker note, reflecting mixed market conditions as the positive market sentiment with mobile-related segments, including RAN and Core, was not enough to offset reduced demand for Broadband Access, Routers and CE Switch, and Optical/Microwave Transport.

Healthy end-user fundamentals and positive 5G momentum outweighed downward risks associated with the COVID-19 pandemic for both RAN and Core investments. The pandemic had a more material impact on some of the non-wireless related segments, driven partly by supply chain disruptions and weakened demand as a result of increased macroeconomic uncertainty.

Mobile RAN and Core revenues together advanced at a single-digit rate, accounting for nearly half of the overall telecom equipment market.

The combined revenues for Broadband Access, Microwave Transport, and Routers and CE Switch declined at a double-digit pace, accounting for about a third of the overall market, the report said.