The telecom infrastructure services (TIS) market resumed year-to-year growth in the quarter owing to strong demand for maintenance services.

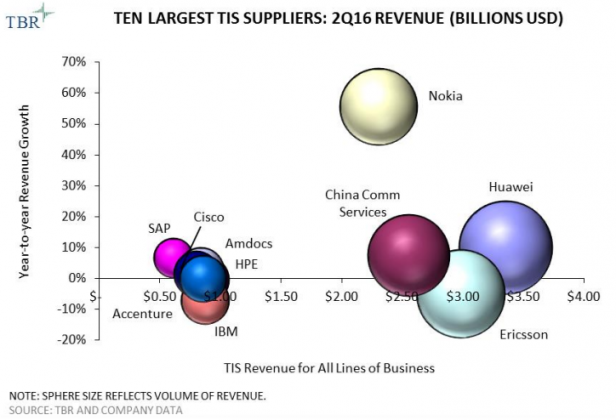

Huawei, Ericsson, IBM, Accenture, SAP, Cisco, Amdocs, HPE, among others, are the leading telecom infrastructure service providers.

The North American telecom infrastructure market is set to drop from $30.4 billion in 2015, to $27.4 billion in 2021, mainly due to operators shifting their focus from network coverage build outs by directing traditional technology investment to software-mediated networks, specifically orchestration, automation, SDN and NFV, as per reports from Technology Business Research (TBR).

The TIS segment seeing maximum growth over the past year has been under maintenance as mobile operators have invested in extended warranties to protect their LTE infrastructure investments and vendors have supported contract renewals to offset weak product sales.

Rise in traffic and hiking demand to lower prices have resulted in lower profits for telecom operators with revenues falling. Adaption of new technological approaches such as SDN and NFV deliver such results and lower capital and operational costs.

SNS Research estimates that service provider SDN and NFV investments will grow at a CAGR of 54 percent between 2015 and 2020. As service providers seek to reduce costs and virtualize their networks, these investments will eventually account for over $20 Billion in revenue by the end of 2020.

According to information from vendor NFWare, more than $600 million was invested last year in SDN and NFV startups. The market also began to witness consolidation efforts that are further reshaping the market.

Also, the NFV and SDN market is expected to grow at a 113.8% CAGR through 2020 to nearly $157 billion. Early adopters such as AT&T started investing in NFV and SDN in 2014, reported TBR.

On average, operators in the U.S. and Europe will contribute for three-quarters of NFV and SDN expenditure each year from 2014-2020 with APAC operators possibly investing more in the later years. Alongside Japan, South Korea, and China operators implementing the technologies, AT&T, Verizon, CenturyLink, BT, DT, Orange and Telefonica will be the major investors in the U.S. and European markets.

Fall in revenue for equipment vendors will also result from fall of traditional service contracts as software-based deployments will not need the same level of vendor upkeep.

With the emerging trend of vendors increasing their exposure to software, via M&A, internal investment, or both, the market is shifting towards software and the portfolios are being modified to align with this trend.

Also, software tends to drive lower services volume compared to hardware builds, resulting in vendors focusing more on cost reduction from a service delivery standpoint to protect profits.

The industry is still in the early stages of a long-term transition to SDN and network functions virtualization (NFV) architected networks.

Three-quarters of carriers participating in the IHS Markit software-defined networking (SDN) survey say they have already deployed or will deploy SDN in 2016; 100 percent plan to deploy the technology at some point.

The top drivers for service provider SDN investments and deployments are simplification and automation of network and service provisioning, as well as service automation. Most telecom operators are moving from SDN proof-of-concept (PoC) evaluations to commercial deployments in 2016 and 2017.

Vina Krishnan

[email protected]