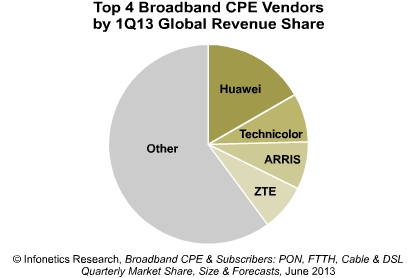

Chinese telecom equipment maker ZTE has lost #2 position in broadband CPE market in the first quarter of 2013 as it slips to 4th rank.

ZTE was overtaken by Technicolor and Arris.

Infonetics Research expects Pace, a key vendor in the broadband CPE market, to challenge for a place in the top 3 this year as its market share in the broadband CPE space continues to grow.

ZTE’s Chinese rival Huawei, the #1 player in the broadband CPE market, has increased its market share. This is primarily due to 26 percent increase in revenue coming mostly from China, Singapore and Malaysia, where it is the primary supplier of GPON ONTs and ADSL CPE.

Huawei recently announced an ultra-broadband-oriented business solution, BOOST at its Global Analyst Summit. The BOOST solution is intended to further the development of the digital society by helping telecom operators to achieve better business results and achieve more sustainable growth.

“Better than expected sales of higher-end cable CPE, including headed and headless video gateways being sold in North America and Europe, helped the broadband CPE market put up another strong quarter,” said Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics Research.

According to an Q4 2012 Infonetics market share and forecast report entitled, “Broadband CPE and Subscribers: PON, FTTH, Cable, and DSL,” ZTE ranked # 1 for both FTTH CPE revenue and shipments in the past year, with a global share of 19.8 percent and 30.9 percent, respectively.

The Chinese telecom equipment maker also shipped more than 100 million broadband CPE devices by the end of 2012, the achievement cements ZTE’s place as a global leader in fixed network operations and large-scale FTTH applications.

ZTE, in April 2013, said that its broadband CPE devices have been deployed in more than 80 countries and regions, with shipments to major European operators growing more than 100 per cent year-on-year. This includes large deployments in China, France, Germany, the Netherlands and Spain.

Globally telecom operators across multiple verticals are in the middle of a long-term transition to higher-speed broadband technologies like FTTH, DOCSIS 3.0 and VDSL2 to keep up with subscriber demand for multiscreen video.

Owing to the continued strong growth of FTTH and cable CPE, the global broadband CPE market reached $2.2 billion in Q1 2013, up 6 percent sequentially and 17 percent from the year-ago quarter.

Though the overall DSL CPE market is slowing on an annual basis, VDSL CPE grew 30 percent y-o-y, particularly in North America and Europe, Middle East, Africa regions.

Headless video gateways will grow at 117 percent CAGR from 2012 to 2017, Infonetics Research said in its telecom research report called 1st quarter 2013 (1Q13) Broadband CPE and Subscribers: PON, FTTH, Cable, and DSL market share, size and forecasts.

Meanwhile, Dell’Oro Group said VDSL port shipments including vectoring products grew more than 15 percent in the first quarter 2013 over the year-ago period and accounted for the majority of DSL port shipments for the first time.

VDSL with vectoring is an attractive alternative to PON for many service providers who want to increase the bandwidth capabilities of their Access networks without the high cost of laying fiber all the way to the user.

“Recent announcements by some large operators regarding their intent to upgrade their access networks with VDSL and vectoring should result in continued VDSL growth over the next several years. Rapidly declining ADSL sales, however, will likely result in the overall DSL market continuing to trend lower, albeit at a slower rate than over the past couple of years,” said Steve Nozik, Principal Analyst of Access research at Dell’Oro Group.

Alcatel-Lucent maintained the leading position in VDSL port shipments, significantly ahead of the next two top vendors, Huawei and ADTRAN, Dell’Oro Group said.