Airtel Africa, a subsidiary of Bharti Airtel, has revealed more details about its initial public offer (IPO) and listing on the London Stock Exchange.

Airtel Africa has submitted related documents for approval to the UK Financial Conduct Authority, it said in a regulatory filing today. The telecom operator did not reveal the IPO size or the timing of the IPO on LSE.

Airtel Africa has submitted related documents for approval to the UK Financial Conduct Authority, it said in a regulatory filing today. The telecom operator did not reveal the IPO size or the timing of the IPO on LSE.

The company offers telecom services in 14 countries in Africa. Airtel Africa is the second largest mobile operator in Africa. Airtel Africa plans to use the proceeds from issue of new shares to reduce debt of $4 billion.

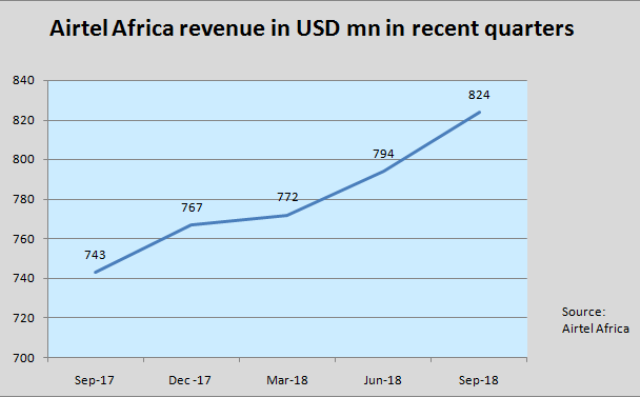

Airtel Africa has 98 million mobile phone subscribers on its 2G, 3G and 4G networks. Airtel Africa reported revenue of $3.077 billion in fiscal 2018-19 as compared with $2.910 billion in fiscal 2017-18.

Airtel Africa has achieved EBITDA margin of 43.3 percent in fiscal 2018-19 as against 39.1 percent in fiscal 2017-18 and 29.2 percent in fiscal 2016-17.

Data customers increased by 5.1 million to 30 million as compared to 24.9 million in the previous year. Data customers now represent 30.4 percent of the total customer base vs 27.9 percent in the previous year. The total MBs on the network grew by 65.3 percent to 392.6 billion MBs.

Customer base on the Airtel Money platform increased 24 percent to 14.2 million from 11.5 million in the previous year. Value of transactions on the Airtel money platform grew 30.5 percent to $ 26.2 billion. Airtel Money revenue rose 59.7 percent to $243.3 million from $152.4 million in the previous year.

Customer base on the Airtel Money platform increased 24 percent to 14.2 million from 11.5 million in the previous year. Value of transactions on the Airtel money platform grew 30.5 percent to $ 26.2 billion. Airtel Money revenue rose 59.7 percent to $243.3 million from $152.4 million in the previous year.

“Since first investing in Africa almost nine years ago, we have well leveraged our expertise in emerging markets to deliver on a clearly-defined strategy to build Airtel Africa into a market leading mobile service provider, increasingly expanding beyond voice into data services and Airtel Money,” Sunil Bharti Mittal, chairman of Airtel Africa, said.

Airtel Africa in March appointed global banks to work on an IPO on the international stock exchange.

J.P. Morgan, Citigroup, BofA Merrill Lynch, Absa Group Ltd, Barclays Bank PLC, BNP Paribas, Goldman Sachs International and Standard Bank Group will assist Airtel Africa to prepare for the IPO.

Airtel Africa earlier received investment from six global investors such as Warburg Pincus, Temasek, Singtel, SoftBank Group International and others for an aggregate consideration of $1.25 billion.