AT&T announced that it added 80,000 post-paid phone subscribers and 45,000 broadband users, but lost 83,000 video subscribers for DirecTV Now during the first quarter of 2019.

AT&T has reduced its dependency on the phone business by buying media content through its acquisition of Time Warner, yet faces a daunting struggle to find growth as declines in one business offset growth in another, Reuters reported.

AT&T has reduced its dependency on the phone business by buying media content through its acquisition of Time Warner, yet faces a daunting struggle to find growth as declines in one business offset growth in another, Reuters reported.

AT&T achieved post-paid phone ARPU of $55.36, Premium Video ARPU of $114.98 and broadband ARPU of $50.10 in the first quarter of 2019.

Capex of AT&T reached $5.2 billion in the first quarter of 2019. Capex in the first quarter of 2018 was $6.1 billion. AT&T is in the process of expanding its 5G mobile presence in the US. 5G reached parts of 19 cities.

Total revenue of the second-largest U.S. wireless carrier by subscribers rose 18 percent to $44.83 billion.

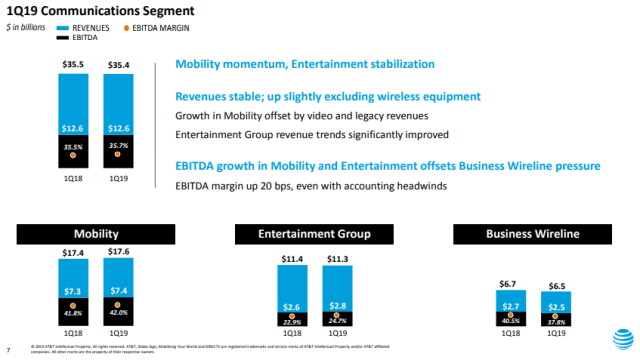

AT&T generated first quarter revenue of $17.6 billion from wireless, $11.3 billion from entertainment and $6.5 billion from wireline business.

AT&T

Mobility $17.567 billion (+1.2%)

Wireless service revenue $13.792 billion (+2.9%)

Entertainment Group $11.328 billion (–0.9%)

Business Wireline $6.498 billion (–3.7%)

Latin America $1.718 billion (–15.2%)

WarnerMedia $8.379 billion (+3.3%)

Xandr $426 million (+26.4%)

Mobility, AT&T’s largest segment which includes its wireless business, had revenue of $17.57 billion during the quarter

WarnerMedia, which includes Turner and premium TV channel HBO, reported revenue of $8.38 billion in the quarter.

Operating expenses were $37.6 billion versus $31.8 billion in the year-ago quarter, an increase of about $5.8 billion due to the Time Warner acquisition.

Operating income was $7.2 billion versus $6.2 billion in the year-ago quarter, primarily due to the Time Warner acquisition, with operating income margin of 16.1 percent versus 16.3 percent.

Net income of AT&T fell to $4.1 billion, or 56 cents per share, from $4.66 billion, or 75 cents per share, a year earlier.