AT&T, whose CEO Randall Stephenson is under pressure to step down, today announced plans for $20 billion investment in 2020.

AT&T also said the CEO transition is not expected in 2020 despite pressure from investment group. AT&T expects revenue growth of 1-2 percent and adjusted EPS growth of $3.60 to $3.70, including HBO Max investment in 2020. AT&T aims for monetization of assets worth $5 billion to $10 billion.

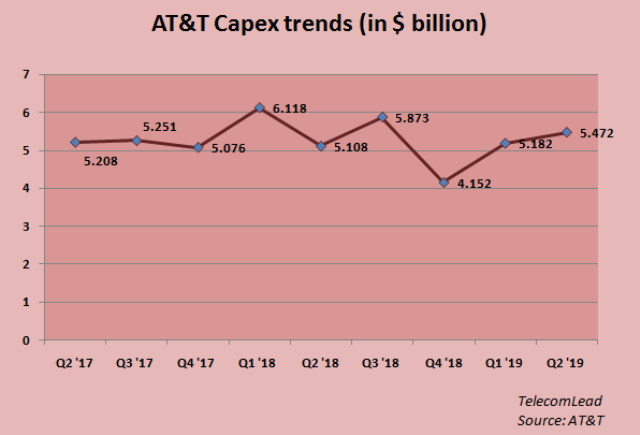

AT&T’s capital expenditures were $5.2 billion during the third quarter of 2019.

Randall Stephenson said: “Our 3-year plan delivers both substantial and consistent financial improvements over the next 3 years. We grow revenues, EBITDA and EPS every single year, and free cash flow is stable next year, but then grows in both of the next two years, as well. And all of this is inclusive of our investment in HBO Max.”

The 3-year financial guidance calls for 1 percent to 2 percent per year consolidated revenue growth and by 2022 an adjusted EBITDA margin of 35 percent, 200 bps higher than 2019 levels. Adjusted EBITDA margins are expected to be stable in 2020 and grow in 2021 and 2022, driven by cost-reduction plan, WarnerMedia synergies, mobility growth and AT&T Mexico EBITDA growth.

The marginal growth in revenue indicates that AT&T is not expecting substantial revenue from its 5G network investment done in the past months.

“By targeting 35 percent EBITDA margins with revenue growth of 1 percent to 2 percent, the company expects about $6 billion of EBITDA growth in 2022, above 2019 EBITDA levels,” Randall Stephenson said.

The company expects to close about $14 billion from monetizing non-core assets in 2019 and $5 billion to $10 billion of non-strategic assets in 2020.

AT&T has reported revenues of $44.6 billion in Q3 2019 versus $45.7 billion in the year-ago quarter. AT&T faced drop in revenue in wireline services, WarnerMedia and domestic video.

It achieved revenue growth in domestic wireless services and IP broadband.

AT&T’s operating expenses were $36.7 billion versus $38.5 billion in the year-ago quarter, down 4.6 percent due to lower intangible asset amortization, lower Entertainment Group costs, lower Warner Bros. film and TV production costs, and cost efficiencies.

AT&T reported operating income of $7.9 billion versus $7.3 billion in the year-ago quarter, due to lower expenses, with operating income margin of 17.7 percent versus 15.9 percent.