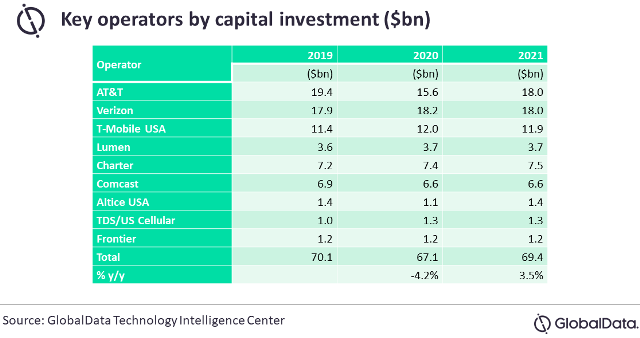

Research firm GlobalData has released the ranking of US-based telecom operators based on the estimated Capex for 2021.

The top nine publicly reported carriers studied by GlobalData have spent in excess of $1 billion in Capex, accounted for just over $67 billion in capital spending. That was down by approximately $3 billion (4.2 percent) in 2020.

GlobalData estimates that AT&T, Verizon and T-Mobile USA collectively account for nearly 70 percent of total Capex — spent roughly $46 billion, down 6.1 percent from 2019. However, the bulk of the decline was attributable to AT&T.

“Following the outbreak of COVID-19, many operators’ capital investment came to a standstill – both due to the disappearance of supporting staff, as employees were forced to retreat to their homes, and to supply chain issues, particularly regarding Chinese suppliers,” John Byrne, service director, Telecom Technology & Software at GlobalData, said.

Most operators outside of the US reported modest year-to-year declines in capex spending. For example:

Telefonica reported a significant year-to-year decline in 2020, reducing capital expenditures from €8.8 billion to €5.9 billion.

America Movil spent approximately 16 percent less in 2020 capex, at $6.7 billion, down from $8 billion.

Orange’s Capex declined slightly from 2019 to 2020, from €7.3 billion to €7.1 billion. However, Orange expects Capex to grow to between €7.6 billion and €7.7 billion in 2021.

Deutsche Telekom and Orange both reported small year-to-year declines.

Capex looks likely to improve modestly in 2021. GlobalData estimates that next year’s spend among these US operators will be up by approximately 3.5 percent. That would return full-year investment to $69.4 billion – just below the $70.1 billion these operators spent on capex in pre-pandemic 2019.