Stephane Teral, senior research director, mobile infrastructure and carrier economics for IHS, has recently revealed the Capex (capital expenditure) of three telecom operators – China Mobile and China Telecom and China Unicom — in China.

Earlier this year, there were reports of Chinese companies falling to the lowest in a time of five years in the first quarter, owing to poor economy in-spite of support from the government.

Only 33 percent firms had reported capital expenditure growth in the first quarter, conveyed survey reports of more than 2,200 firms by China Beige Book International (CBB).

Following upon this, all telecom sector industries have continued to report a cut in their Capex and hiring.

China Unicom

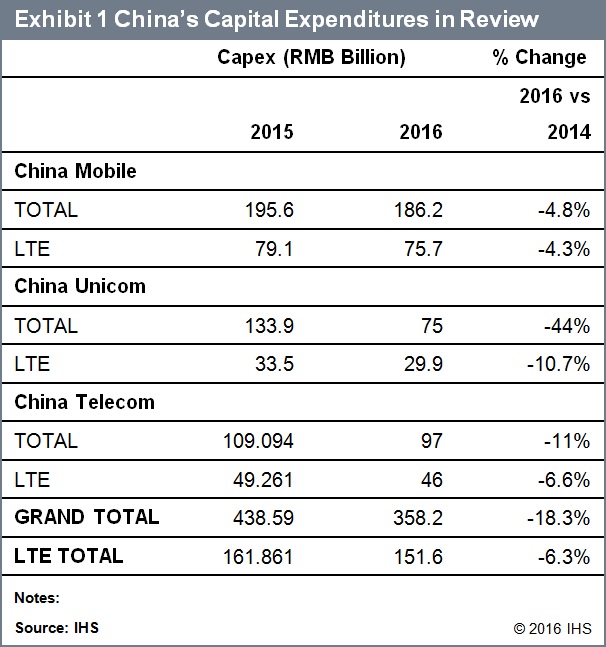

Topping the list, China Unicom plans to cut Capex by 44 percent, and is trailed by China Telecom aiming a 11 percent cut, and China Mobile with a 4.8 percent slash.

All the above telecoms were given the benefit of operational and Capex savings, owing to the implementation of tower sharing handled by a joint venture company named China Tower.

China Tower shares can be segregated into 38 percent owned by China Mobile, 28 percent each by China Unicom and China Telecom, respectively.

Remaining 6 percent belongs to the state owned China Reform Holding Company (CRHC), controlled by Assets Supervision and Administration Commission (SASAC).

It was reported earlier in the year that the shares of firms reporting Capex growth have fallen by over 40 percent since the second quarter of 2014, continuing to sink further.

Also, the government has the growth target of 6.5 percent to 7 percent for this year, with the economy seeing the slowest pace in 25 years, with an expansion of 6.9 percent in 2015.

China Unicom and China Telecom agreement

After an agreement signed in January this year, China Unicom, intent on cutting down Capex via strategic cooperation in collaboration, with arch rival China Telecom, plans to save RMB59.9B, as a result of a 44 percent cut.

Both the companies are working to co-build and share mobile and transmission networks for remote areas and indoor venues, and claim to accelerate shared infrastructure deployment, to enhance mobile coverage and performance.

The tie up among China Unicom and China Telecom can create a possible two-operator market in China, but a merger between the state-backed-carriers is not a possibility, as such a move will contradict government agendas.

China Unicom plans RMB20.6B or a 75 percent reduction in 2G/3G spending while boosting the transformation to the LTE network. Also, fixed-line broadband and data spending is to be halved while infrastructure, transmission and others face a 46 percent cut-down. The total Capex budget of the group is at CNY75 billion.

The addition of 310k eNodeBs (eNBs), enlarging its footprint to 400k, has enabled the telecom to complete the coverage phase of its network build for LTE alone.

At the same time, it is set to add another 280k eNBsto uplift coverage and quality, by the end of 2016.

China Telecom

China Telecom, paving the way for a potential 800MHz re-farming for 4G use, centers on enhancing the LTE coverage in towns, villages, and rural areas while up-scaling the LTE footprint in all cities.

The firm has a Capex budget of CNY97 billion set for 2016, compared to the CNY109 billion, last year.

China Telecom, having added 330k eNBs last year, going about 50k above the initial plan, has a current LTE footprint of 510k eNBs. It also plans on a further addition of 290k this year to reach the 800k eNBs bar.

In-spite of the cut, China Telecom’s Capex will continue to be high for upcoming one or two years, owing to the 4G network rollout and accelerated fibre upgrade, conveyed the research group, Fitch Ratings.

China Mobile

In parallel to the above, China Mobile has centered on constantly lowering its Capex per year, with a 9 percent Capex reduction in 2014, and a 5 percent cut in the previous year. China Mobile plans on an 18 percent reduction with transmission being affected the most as it will receive lower priority in comparison to business networks, support systems, buildings, infrastructures, powers, and others.

Overall, China Mobile plans to lower its Capex by 5 percent in 2016, spending CNY186 billion.

Also, transmission had seen a growth in 2015, extending the inter-provincial backbone network capacity to 250 percent, while 380k eNBs were added in LTE last year, expanding the reach to 1.1 million, with 300k more eNBs to be added this year.

The researches and reports sum up to point out that the Chinese continent telecom sector is also becoming prone to market saturation, lack of differentiation, stagnant or declining blended ARPUs, declining voice and SMS revenues, and fierce competitive pressures.

Vina Krishnan

[email protected]