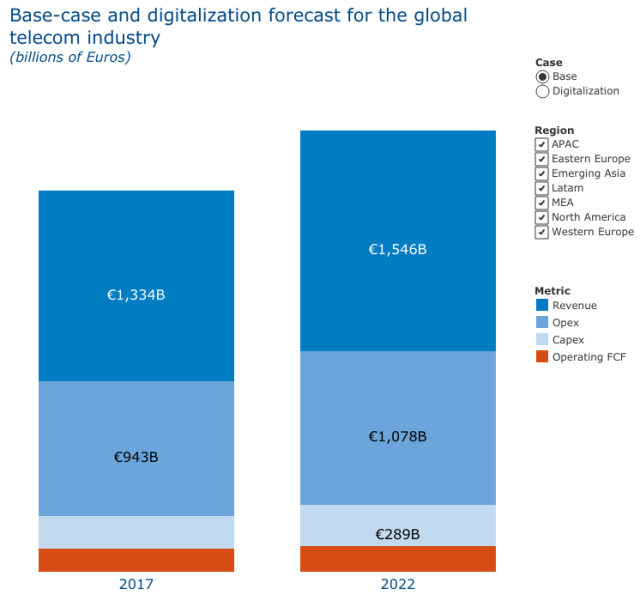

Digital transformation will assist telecom operators to yield EUR 200 billion or $227 billion in operating free cash flow (opFCF), Arthur D. Little (ADL) report said.

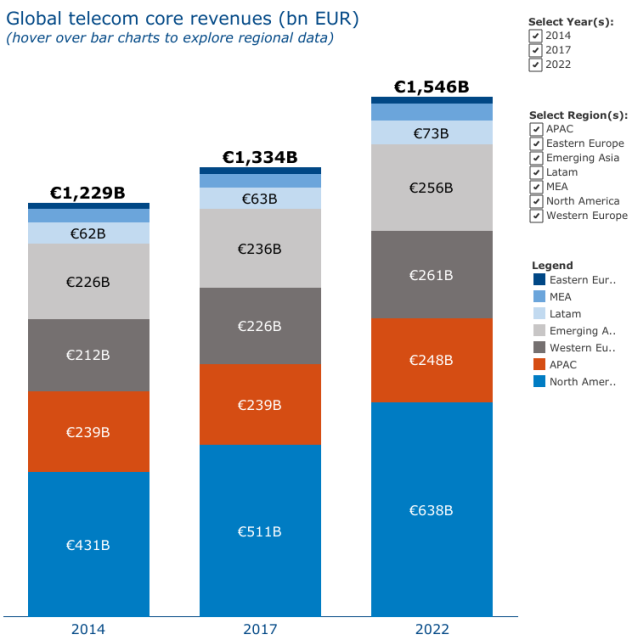

Global telecoms posted low-single-digit global revenue growth from 2014 to 2017 — mainly driven by North America. Operators have struggled to grow wireless revenues in established markets due to saturation.

Global telecoms posted low-single-digit global revenue growth from 2014 to 2017 — mainly driven by North America. Operators have struggled to grow wireless revenues in established markets due to saturation.

GSMA says North America’s wireless subscriber penetration has peaked and is expected to grow only 2 percent from 2017 to 2025.

Telecom operators in North America achieved wireless revenue CAGR of 1.1 percent from 2014 to 2017.

Eastern and Western Europe experienced wireless revenue CAGRs of 0.9 and 2.4 percent, respectively, from 2014 to 2017.

Eastern and Western Europe experienced fixed-revenue CAGRs of 1.5 and 2.1 percent, respectively.

In Western and Eastern Europe, regulatory pressure has also had considerable impact on top-line figures. The rising number of OTT alternatives to traditional telecoms voice and pay-TV services has resulted in competitive pricing, which has caused further ARPU erosion, as well as subscriber loss.

Revenue

Telecoms revenues will be growing at 3 percent CAGR globally from 2017 to 2022 – mainly due to increased high-speed wireless data coverage in emerging markets, higher revenue from fixed infrastructure, and new use cases enabled by 5G deployments in more mature telecoms markets.

Telecoms will be making new revenues from 5G from new B2B and B2B2X use cases. But there will be no significant incremental revenues from consumer 5G services.

Telecoms will be making new revenues from 5G from new B2B and B2B2X use cases. But there will be no significant incremental revenues from consumer 5G services.

Telecom operators in Latin America and the Middle East and Africa (MEA) will achieve total revenue CAGRs of 5.2 and 4.9 percent, respectively, from 2017 to 2022 – due to increasing wireless coverage and subscriber penetration.

North America’s telecom operators will be achieving total revenue CAGR of 4.6 percent from 2017 to 2022.

Capex

Global telecoms Capex will be growing at CAGR of 7 percent from 2017 to 2022 – a rate that is more than double the historical CAGR and outpaces the forecast growth in global telecoms revenue for the same period.

Main focus will be on 5G deployment and fiber network expansion in mature telecoms markets, as well as LTE investments in emerging markets.

Main focus will be on 5G deployment and fiber network expansion in mature telecoms markets, as well as LTE investments in emerging markets.

Capital investments to contribute significantly to the erosion of free cash flows for telecoms operators from 2017 to 2022.

Global telecoms Opex will increase at a CAGR of 2.7 percent from 2017 to 2022, which is roughly in line with the historical growth.

Digitalization

Digitalization is the application of digital technologies and interfaces, new ways of working to change an existing business model and create incremental revenue and other value-adding opportunities.

Digitalization of the telecoms industry can have a significant positive impact on operator financial performance, but operators have to act now to generate incremental cash flows from digitalization.

Mobile operators can make core business activities more efficient and reduce time to market for new products. The result of the digitally enabled revenue acceleration and growth opportunities is 1–2 percentage-point uplift in revenue-growth over the next five years.

Telecoms operators will make Opex savings across from digital transformation, with Opex CAGR over the next five years slowing to 1 percent from the base case projection of 2.7 percent.

Digital transformation related investments do not significantly impact the total projected Capex CAGR at approximately 7 percent.

Aside from digital transformation, consolidation and new technologies, such as 5G and the IoT, are also expected to play an important role in shaping the telecoms industry, the report said on Monday.

The analysis report the vast majority of global telcos are still at a relatively early stage of digital maturity. The analysis is based on the latest available financial results of 190 telecoms operators globally, their historical performances since 2014, and their projected performances until 2022. ADL conducted a survey of more than 100 telco senior executives on digital transformation.