e& has revealed its capital expenditure, Opex, subscriber growth and revenue for the first quarter of 2023.

Capex

Capex

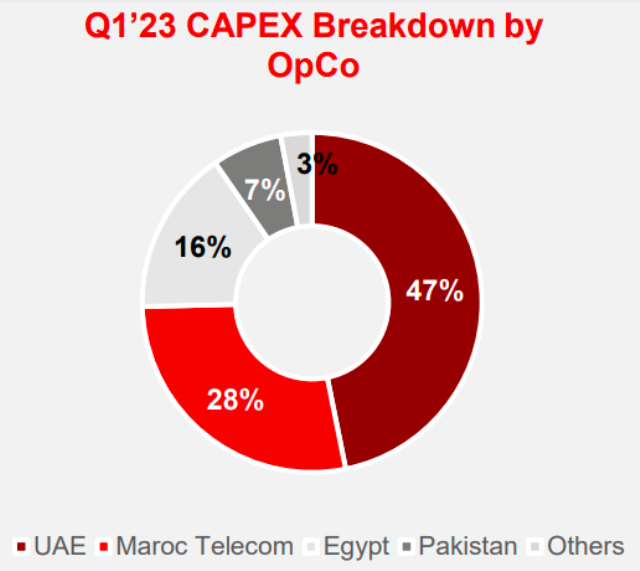

Capital expenditure of e& decreased 33 percent to AED 1.1 billion in the first quarter of 2023 focused on expansion of mobile and fiber networks in key markets. Capital intensity ratio was 8 percent in Q1 2023. Excluding spectrum costs from prior period, Capex dropped by 19 percent.

In the UAE, Capex increased 43 percent to AED 0.5 billion with capital intensity ratio of 6 percent. Capital spending focused on networks modernization, 5G network rollout and network maintenance.

Capex in e& international fell by 54 percent to AED 0.6 billion. International operations represented 52 percent of the Group’s total consolidated capital expenditure.

In Maroc Telecom, Capex decreased 31 percent to AED 0.3 billion with capital intensity ratio of 10 percent. Capital spending declined 43 percent in Morocco, while increased 7 percent in Moov Africa’s operations. Capital spending focused on expanding fibre-tothe-home (FTTH) and 4G mobile network coverage.

In Maroc Telecom, Capex decreased 31 percent to AED 0.3 billion with capital intensity ratio of 10 percent. Capital spending declined 43 percent in Morocco, while increased 7 percent in Moov Africa’s operations. Capital spending focused on expanding fibre-tothe-home (FTTH) and 4G mobile network coverage.

In Egypt, Capex decreased by 70 percent to AED 0.2 billion with capital intensity ratio of 21 percent. Capital spending focused on 4G deployment and upgrading of network capacity.

In Pakistan, Capex fell 69 percent at AED 0.1 billion with a capital intensity ratio of 12 percent. Capital spending focused on expansion of FTTH network and enhancement of the fixed network’s capacity.

Hatem Dowidar, Group Chief Executive Officer of e&, said: “We will explore future technologies and develop new verticals that will accelerate digital transformation, positively impacting businesses.”

e& said its total number of subscribers as of 31 March 2023 stood at 164 million, recording the highest number of subscribers in the Group’s history. E& added 4.8 million during the last 12- month period, mainly due to strong subscriber acquisition in Egypt, UAE, Pakistan, Burkina Faso, Gabon, Chad, Togo, Central African Republic and Benin.

E& said revenue fell 2.5 percent to AED 13 billion. First quarter revenue witnessed significant exchange rate volatility in the Egyptian Pound, Pakistani Rupee and Moroccan Dirham as a result of global macro-economic turbulence overshadowing robust operational performance in local currency.

E& generated revenue of AED 8.0 billion (+2.1 percent) in the UAE, AED 4.6 billion (–13.7 percent) in International, AED 3.1 billion (–5 percent) in Maroc Telecom, AED 0.8 billion (–37 percent) in Egypt, and AED 0.6 billion (–16 percent) in Pakistan.

Operating expenses was AED 8.7 billion, an increase of 5 percent compared to the same quarter of the previous year and a decrease of 2 percent from the fourth quarter of 2022. The increase was mainly due to global inflationary pressures, especially with double digit inflation growth in both Egypt and Pakistan. However, this was offset by lower marketing, depreciation and network costs, among others.