Frontier Communications CEO Dan McCarthy has revealed the company’s main gains in the second quarter ended June 30, 2019.

Frontier lost 93,000 consumer customers to close the second quarter with 3.902 million customers. It lost 71,000 broadband subscribers with the number of Internet customers reaching 3.626 million during the second quarter.

Frontier lost 93,000 consumer customers to close the second quarter with 3.902 million customers. It lost 71,000 broadband subscribers with the number of Internet customers reaching 3.626 million during the second quarter.

Frontier also lost 46,000 video subscribers and 8,000 DISH subscribers during the second quarter of 2019.

Frontier has reported monthly ARPU of $88.68 in the June quarter of 2019 vs $89.14 in the March quarter of 2019. Monthly churn among customers increased to 2.14 percent in June quarter of 2019 vs 1.99 percent in March quarter of 2019.

Consolidated revenue for the second quarter of 2019 was $2.07 billion, as compared with $2.10 billion in the first quarter.

Frontier has generated consumer revenue of $1.05 billion and commercial revenue of $922 million.

Second quarter Adjusted EBITDA was $882 million, representing Adjusted EBITDA margin of 42.7 percent. This compares with Adjusted EBITDA of $873 million in the first quarter of 2019.

“Though we achieved Adjusted EBITDA of $882 million, we continue to be challenged by ongoing revenue declines, content cost escalations, higher labor costs, and other pressures across the business,” Dan McCarthy said.

Frontier posted net loss of $5.32 billion. Net loss includes $5.45 billion goodwill impairment, $384 million loss on the sale of business in Washington, Oregon, Idaho, and Montana, and $31 million of restructuring expenses.

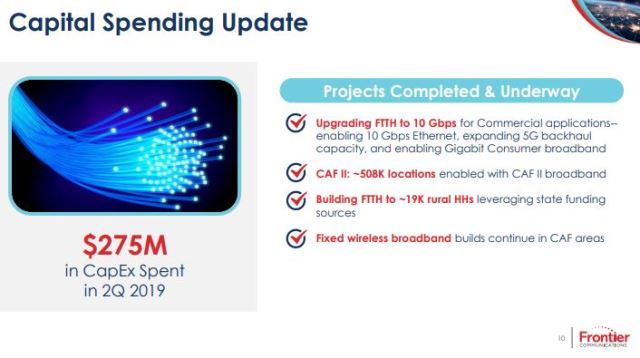

Frontier Communication has lowered its second quarter Capex to $275 million in the June quarter as compared with $305 million in the March quarter. Frontier is expected to spend $1.20 billion towards capital expenditures (Capex) in 2019.

Consumer Business

Frontier’s Consumer Business revenue of $1.05 billion declined due to customer losses. Customer churn of 2.14 percent was impacted by seasonality, an elevated level of roll-off of bill credits offered to customers in 2017, and industry pressure.

Frontier’s consumer fiber broadband net loss were 10,000 and consumer copper broadband net loss were 46,000. Both Consumer fiber broadband and Consumer copper broadband revenue declined. Broadband accounts for more than 40 percent of Consumer revenue in Q2 2019.

Commercial Business

Frontier’s Commercial Business revenue was $922 million. Total number of commercial customers reached 390,000 compared with 400,000 during the first quarter of 2019.

Commercial wholesale revenue fell 0.5 percent sequentially, with the decline in legacy circuits and voice being nearly offset by the increase in Ethernet and other services. Wholesale represents slightly more than half of Commercial revenue. Wireless backhaul, one element of wholesale revenue, represents less than 3 percent of total company revenue.

Frontier’s Commercial SME revenue fell 1.8 percent sequentially largely driven by the decline in voice services during the second quarter of 2019. Voice revenue accounts for approximately half of SME revenue.