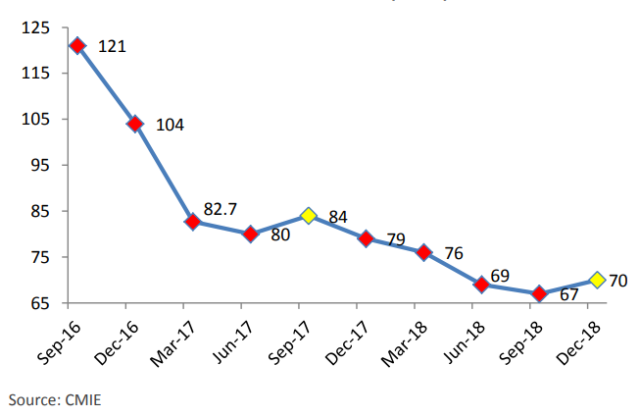

Indian mobile operators’ Average Revenue per User (ARPU) increased during the December quarter of 2018 on a quarter-on-quarter basis after the introduction of new pricing plans.

ARPU of mobile operators improved sequentially for the first time after a gap of 4 quarters in the December 2018 quarter. The increase in ARPU was primarily on the back of introduction of minimum recharge plans by the incumbent telecom players, said Madan Sabnavis, chief economist, and Bhagyashree C Bhati, research analyst at Care Ratings in their latest report revealed on Monday.

ARPU of mobile operators improved sequentially for the first time after a gap of 4 quarters in the December 2018 quarter. The increase in ARPU was primarily on the back of introduction of minimum recharge plans by the incumbent telecom players, said Madan Sabnavis, chief economist, and Bhagyashree C Bhati, research analyst at Care Ratings in their latest report revealed on Monday.

The introduction of Reliance Jio into the Indian telecom market has resulted into a year-on-year drop in the ARPU of the telecom industry. ARPU fell sequentially in each of the quarters except for the September 2017 quarter and the December 2018 quarter where the ARPU increased on a q-o-q basis.

Price war due to cheap data services and competition among the telecom service providers is responsible for the downtrend in the industry’s ARPU.

The reason for the introduction of minimum recharge plan is the consistent fall in data ARPU when the share of revenue from data in ARPU is on a rise. The share of revenue from data usage increased to 53 percent in ARPU during the December quarter compared to the share of 21.6 percent in December 2016 quarter.

The average data ARPU fell by 93.4 percent to Rs 10.5 per GB in the December 2018 quarter against Rs 160 per GB data in the December 2016 quarter. The increase in the share of data revenue in ARPU is on account of a surge in volume of data usage.

The data usage per subscriber per month which averaged at 0.88 GB in the December 2016 quarter rose by 893 percent to 8.74 GB in the December 2018 quarter due to cheap data prices.

While data ARPU continues to remain weak, the volume of data usage tends to be on a rise. This requires the telcos to manage more data traffic with lower revenues from data which, in turn, has hurt the revenues and profitability of the telecom industry. Managing more data traffic increases telcos’ network costs.

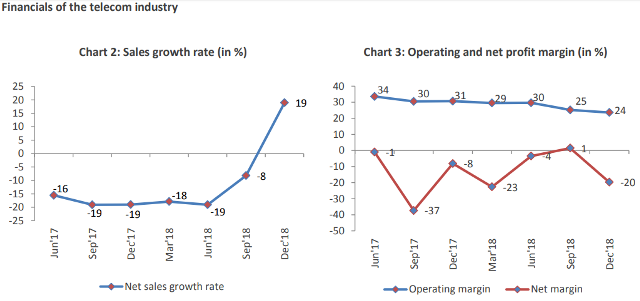

The industry’s sales declined in double digits in each of the quarters during the period June 2017 quarter to June 2018 quarter on a y-o-y basis. The industry made losses at the operating level and the industry’s net margin remained in the range of 29 percent-34 percent during the period.

The share of revenue from calls fell in ARPU with the introduction of cheap data services by Reliance Jio in September 2016. Reliance Jio used 4G VoLTE technology to offer services which allows subscribers to use internet or data plans to make calls, send SMS or browsing internet.

Airtel and Vodafone Idea introduced minimum recharge plan to restrict the fall in revenues and to increase the ARPU. They introduced the minimum recharge plans starting from Rs 35 with a validity of 28 days in the December 2018 quarter at pan India level.

The aim of the minimum recharge plan is to retain the revenue generating subscribers and to discontinue with the incoming-only customers or the minimal ARPU customers.

The subscriber base of Bharti Airtel declined 0.93 percent sequentially to 344.3 million subscribers during the December 2018 quarter.

The subscriber base of Vodafone Idea fell 3.7 percent sequentially to 419 million subscribers during the December 2018 quarter.

Vodafone Idea and Bharti Airtel will continue the minimum recharge plans and will result in termination of services to minimal ARPU customers and will help improve the ARPU level of incumbents.

The report forecasts that the industry ARPU will improve on sequential basis and increase by 9 percent-10 percent on a year-on-year basis to average at around Rs 76 – Rs 77 for the fiscal 2019-2020.