MTN Group CEO Rob Shuter today announced the key focus areas of the telecom operator during 2019.

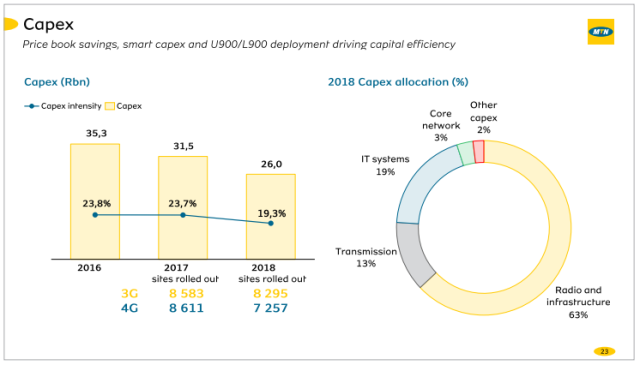

MTN has lowered its Capex to R26 billion in 2018 as compared with R31.5 billion in 2017 and R35.3 billion in 2017.

MTN has rolled out 8,295 3G sites in 2018 as compared with 8,583 3G sites in 2017. MTN added 7,257 4G sites in 2018 as against 8,611 4G sites in 2017.

MTN has invested 63 percent of its Capex towards radio and other infrastructure, 13 percent for transmission, 19 percent for IT systems, 3 percent for core networks, and 2 percent for other areas.

MTN has reduced Capex spending in all regions.

MTN Capex reached R9.448 billion (R11.47 billion in 2017) in 2018 in South Africa, R6.888 billion (R8.953 billion) in Nigeria, R3.796 billion (R3.794 billion) in SEAGHA region, R3.28 billion (R3.696 billion) in WECA, R2.194 billion (R2.294 billion) in MENA, R3.716 billion (R9.274 billion) in Iran and R457 million (R1.253 billion) in others in 2018.

MTN, as part of its BRIGHT strategy, aims to build MTN into a digital operator with a major focus on the fin-tech, digital, enterprise and wholesale business areas.

Key focus areas for 2019 are the launch of its own music streaming and instant messaging applications.

MTN will be extending its mobile money service from 14 to 18 countries through launches in South Africa, Nigeria, Afghanistan and Sudan.

“We see significant opportunity to grow subscribers and voice revenue as we also execute on the large mobile data opportunity,” said Rob Shuter.

MTN aims double-digit growth in service revenue, improvement in profit margins and Capex efficiency. MTN has set a target to drive return on equity from 11 percent to over 20 percent in the next three to five years.

MTN achievements

MTN said it increased its subscriber base by 16 million to 233 million customers across 21 markets in Africa and the Middle East. The number of active data users rose by 10 million to 79 million. MTN’s active mobile money subscriber base rose to 27 million.

MTN’s service revenue rose 10.7 percent to R125,4 billion in 2018. MTN’s EBITDA rose 15 percent.

MTN will be monetizing its investments in e-commerce and tower companies. The group has R40 billion tied up in the value of the e-commerce and tower company investments. MTN aims to realise more than R15 billion over the next 3 years excluding any proceeds from its R23 billion position in IHS.

MTN CFO Ralph Mupita said the group stabilised its gearing, bringing the holding company leverage down to 2.3 times at December 2018 from 2.9 times at June 2018 and within the target range of 2 to 2.5 times. MTN Group’s overall gearing moderated to 1.3x.

Baburajan K