Ooredoo CEO Sheikh Saud bin Nasser Al Thani has explained how the group improved its performance during the third quarter of 2019.

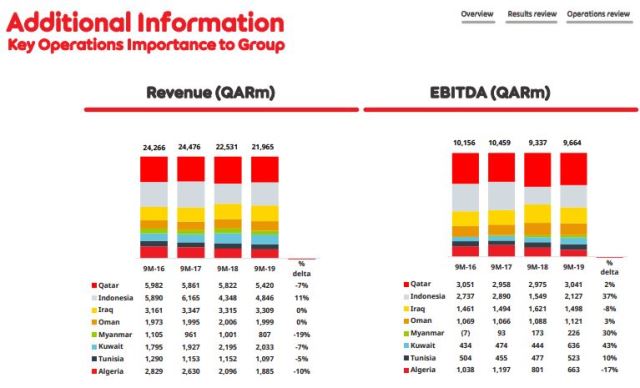

Ooredoo Group revenue dropped 3 percent to QAR 22.0 billion as a result of fewer handset sales, macroeconomic and currency weakness in some of the markets.

EBITDA of Ooredoo rose 4 percent to QAR 9.7 billion with EBITDA margin of 44 percent, driven by efficiency program.

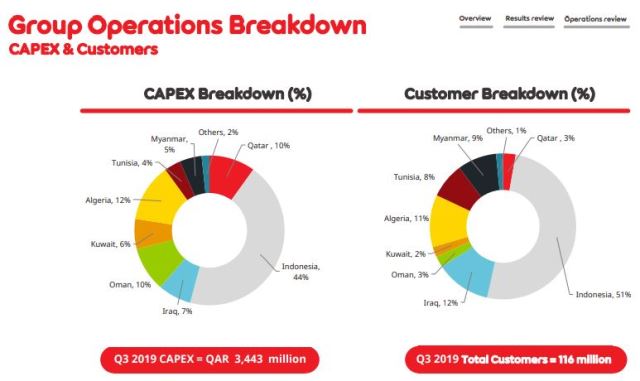

Ooredoo Group added one million new customers to its network in Q3 taking the total to 116 million — mainly driven by new customers in Indonesia and Iraq.

Ooredoo Capex

Indosat Ooredoo, Ooredoo Tunisia and Ooredoo Myanmar deployed 4G network. Ooredoo Algeria’s 4G network covered 64 percent of the population in the country.

Ooredoo Group leads in 5G adoption with live commercial 5G networks in Qatar and Kuwait and 5G testing in Oman. Ooredoo did not reveal the revenue returns from the investment in 5G networks.

Ooredoo Myanmar deployed more LTE1800 sites, contributing to quarter-on-quarter growth in revenues for the quarter. In Algeria, 4G network expansion continued with 64 percent of the population covered.

Indosat Ooredoo in Oct 2019 signed a Sales and Leaseback Agreements with Mitratel and Protelindo for the sale of 3,100 telecommunications towers in Indonesia for a total transaction value of approx. QAR 1.6 billion.

“Our focus on efficiency and digitisation continues to deliver positive results as we harness group wide synergies to deliver award winning products and services for our customers,” Sheikh Saud bin Nasser Al Thani, chief executive officer of Ooredoo said.

Ooredoo Qatar

Ooredoo Qatar’s revenue dropped to QAR 5.4 billion in 9 months of 2019 from QAR 5.8 billion impacted by lower handset sales. EBITDA was QAR 3.0 billion, an increase of 2 percent, enabled by an increasing focus on digitisation and a range of cost optimisation measures, including renegotiating major content deals. Customer numbers stood at 3.2 million.

Ooredoo Oman

Ooredoo Oman’s stable revenues at QAR 2 billion was driven by a strong performance in the fixed line segment for the nine-month period of 2019. EBITDA increased 3 percent to QAR 1.1 billion, and EBITDA margin was 56 percent vs 54 percent.

Ooredoo Oman’s customer base increased 2 percent to 3 million in the nine-month period as compared to 2.9 million — driven by Ooredoo’s roll out of its Maktabi+ packages.

Ooredoo Kuwait

Ooredoo Kuwait’s revenue dropped to QAR 2 billion vs QAR 2.2 billion, mainly due to a reduction of handset sales. EBITDA margin improved to 31 percent vs 20 percent, supported by fewer handset sales and better market pricing.

Ooredoo Kuwait’s customer base increased to 2.6 million for the nine-month period, up by 13 percent compared to 9M 2018, driven by a good uptake of our data and voice packages and promotions.

Ooredoo Kuwait launched 5G plans with handset bundles.

Asiacell – Iraq

Asiacell has posted stable revenues of QAR 3.3 billion and EBITDA of QAR 1.5 billion (–8 percent) with EBITDA margin of 45 percent due to increase in costs related to improvement in network quality, network expansion, and sales and marketing activities. Asiacell’s mobile phone customer base increased 6 percent to 14 million.

Ooredoo Algeria

Ooredoo Algeria reported drop in revenues at QAR 1.9 billion vs QAR 2.1 billion. EBITDA was QAR 663 million vs QAR 801 million. Ooredoo Algeria’s customer base was 13.4 million.

Ooredoo Tunisia

Ooredoo Tunisia revenue fell 5 percent to QAR 1.1 billion due to 15 percent depreciation of the Tunisian Dinar.

EBITDA increased 10 percent to QAR 523 million, contributing to an EBITDA margin of 48 percent vs 41 percent in 2018. Growth was supported by the ongoing implementation of Ooredoo Tunisia’s efficiency program and digitisation. Ooredoo Tunisia’s customer base grew 3 percent to 9.1 million.

Indosat Ooredoo

Indosat Ooredoo posted 11 percent hike in revenues to QAR 4.8 billion after implementing refreshed commercial strategy to attract longer term, higher value customers and reduce churn. Indosat Ooredoo’s customer numbers increased sequentially by 2 million in Indonesia.

Ooredoo Myanmar

Ooredoo Myanmar’s revenue dropped to QAR 807 million vs QAR 1 billion due to price competition in the market, following the entrance of the fourth operator.

Ooredoo Myanmar increased its customer base by 6 percent to 10 million customers, driven by the company’s strategy to expand its digital distribution network. The company increased its Ooredoo App monthly active users to 1.3 million, while its VIP digital loyalty program reached 1.6 million users.