Analyst firm TBR has revealed top three predictions for the global telecom industry in 2023 indicating that their business will be under extreme pressure.

TBR Principal Analyst Chris Antlitz said 2023 will likely be one of the most uncertain and challenging periods in the telecom industry’s history.

The challenges faced by communication service providers (CSPs) include rising interest rates; inflation; lack of 5G ROI; technological complexity; energy costs; supply chain disruption; new competitors; labor strikes; and economic recession.

#1

TBR expects global financial market and business conditions to deteriorate significantly in 2023, with the telecom industry likely to be among the hardest-hit sectors due to structurally high leverage and weakening business fundamentals.

#2

CSP spend on 5G infrastructure will be post-peak in major countries, specifically the U.S., China, Japan and South Korea, in 2023 after an unprecedented pull forward in demand during the pandemic. Most CSPs in Europe and developing markets (most notably India) still need to go through their 5G investment cycles, but the spend magnitude will be at a lower level in aggregate compared to the investments made in the key postpeak countries, resulting in a net decline in global spend.

The 5G cycle has not played out as originally anticipated, with many CSPs proving reluctant to invest in 5G standalone (SA) and open vRAN due to high costs and uncertain ROI. CSPs will continue investing in 5G infrastructure, but LTE will remain the coverage backbone (and mobile core anchor for most CSPs under the non-standalone (NSA) architecture), at least until the ROI to justify broader 5G spend comes into focus.

#3

Leading U.S.-based cablecos are expected to expand commercial deployments of their cellular networks in 2023 after building small-scale sites for trial and offload purposes in 2022. Comcast and Charter are using Verizon’s network, while Altice uses T-Mobile to carry their mobile traffic via mobile virtual network operator (MVNO) agreements.

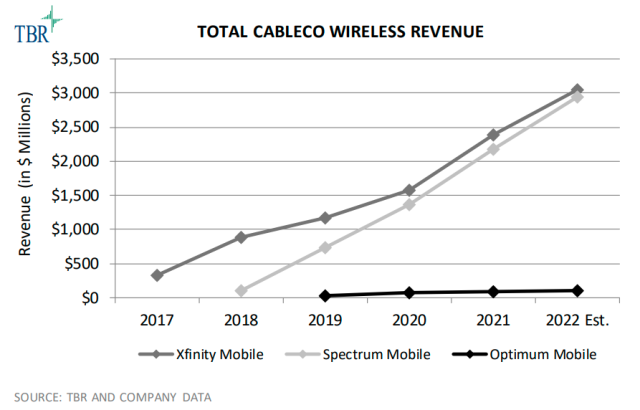

U.S. cablecos’ wireless businesses have grown, adding nearly 9.9 million subscribers — accounting for 2.1 percent of total U.S. wireless market revenue as of September 2022.

Comcast plans to use 600MHz and CBRS spectrum for its cellular network. Charter has not yet revealed details about its cellular network. Charter may follow Comcast’s approach and will start construction in 2023.

Cablecos’ presence in wireless business represents challenge for telcos, especially AT&T, Verizon, and smaller-scale players such as UScellular and C Spire. T-Mobile is likely to be largely unaffected from the competition from cable business due to the company’s strong value proposition.