The latest TRAI report reveals that India’s mobile phone customer-base rose 0.14 percent to 1,183.68 million in Feb 2019 from 1,181.97 million in Jan 2019.

Reliance Jio’s 16 percent customers are in-active, the TRAI report shows. Less than 4 percent customers are in-active in the case of Bharti Airtel. Nearly 8 percent customers are in-active on Vodafone Idea network. 44 percent customers are in in-active on the BSNL network.

India’s mobile phone subscribers in urban areas reached 656.57 million. Rural phone users declined to 527.11 million from 527.77 million.

India’s mobile phone density increased to 90.20. Phone users’ density in urban areas reached 157.18 in Feb 2019. Rural phone customers’ density declined to 58.93.

The below chart shows that Vodafone Idea has 34.58 percent share in the Indian wireless market. Airtel has 28.75 percent share of the wireless customer base. Reliance Jio has 25.11 percent of the wireless customer base — including both active and non-active in India.

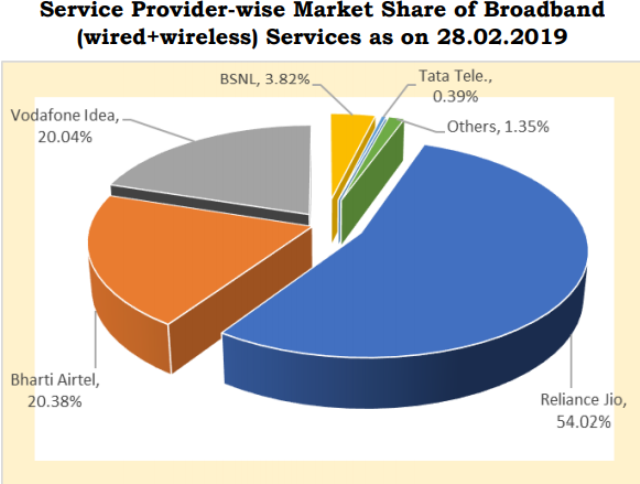

TRAI said the number of broadband subscribers reached 550.24 million in Feb 2019 with a monthly growth rate of 1.89 percent.

Top broadband service providers are Reliance Jio Infocomm (297.23 million), Bharti Airtel (112.13 million), Vodafone Idea (110.25 million), BSNL (21.01 million) and Tata Tele (2.17 million).

Top wired broadband service providers are BSNL (9.17 million), Bharti Airtel (2.33 million), Atria Convergence Technologies (1.41 million), Hathway Cable & Datacom (0.79 million) and MTNL (0.76 million).

Top wireless broadband service providers are Reliance Jio (297.23 million), Vodafone Idea (110.23 million), Bharti Airtel (109.80 million), BSNL (11.84 million) and Tata Teleservices (1.72 million).