Japanese telecom and Internet major SoftBank today announced its deal to buy ARM Holdings for $31.4 billion in cash.

SoftBank is spending a whopping $31.4 billion cash to buy ARM Holdings that reported $398 million revenue (+14 percent) in the first quarter of 2016. ARM Holdings has 48.6 percent operating margin.

The board of SoftBank and ARM Holdings approved the cash deal.

The strategy of SoftBank is to expand its presence in the growing IoT market. The size of the global IoT market will be $150 billion in 2016 and will grow to $550 billion by 2025, said Strategy Analytics.

“The entire global IT opportunity value will be in the $3.5 trillion range in 2016. We project IoT to grow to be about 11 percent of total IT spending by 2025,” said Andrew Brown, executive director of IoT strategies at Strategy Analytics.

SoftBank aims to retain preserve the ARM organization, including its existing senior management team, brand, partnership-based business model.

The headquarters of ARM will continue to be in Cambridge, the UK.

SoftBank aims to double the number of employees in the UK over the next five years and increase the headcount of ARM outside the UK over the next five years.

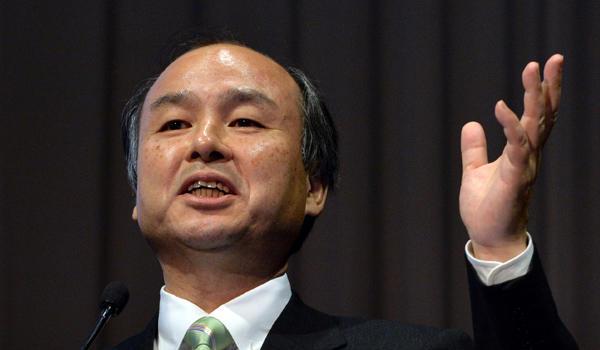

Masayoshi Son, chairman and CEO of SoftBank, said: “ARM will be a strategic fit within the SoftBank group as we invest to capture the very significant opportunities provided by the “Internet of Things”.

Semiconductor market

Gartner says the size of the global semiconductor market in terms of revenue was $333.7 billion (–1.9 percent) in 2015. The top 25 semiconductor vendors’ revenue increased 0.2 percent. The top 25 vendors accounted for 73.2 percent of total market revenue against 71.7 percent in 2014.

IT industry research firm Gartner does not list ARM Holdings in its top 10 semiconductor firms in 2015.

Intel posted 1.2 percent revenue decline, due to falls in PC shipments. Samsung’s memory business helped drive growth of 11.8 percent in 2015, and the company maintained the No. 2 spot with 11.6 percent market share.

Worldwide semiconductor capital spending is projected to decline 4.7 percent to $59.4 billion in 2016, according to Gartner.

Recent semiconductor deals

The total size of M&A deals in the global semiconductor industry crossed $120 billion in 2015.

Some of main semiconductor M&A deals during 2014-2015 were: acquisition of Broadcom by Avago Technologies, CSR by Qualcomm, Altera Corporation by Intel Corporation, Freescale Semiconductor by NXP Semiconductors, Atmel by Dialog Semiconductor, and SanDisk by Western Digital, among others.

Cypress Semiconductor will acquire Broadcom’s Wireless IoT business for $550 million in cash. Broadcom’s IoT business unit, which employs approximately 430 people, generated $189 million in revenue during the last twelve months.

Infineon will be purchasing Wolfspeed Power and RF division (Wolfspeed) of Cree for $850 million. The business to be acquired by Infineon has generated pro-forma revenues of $173 million in the twelve months ending March 27, 2016.

Baburajan K

[email protected]