T-Mobile US said it would be making an investment of $4.8 billion to $5.1 billion towards capital expenditure (Capex) in 2017 – mainly focusing on investment in the expansion of its 4G LTE network.

T-Mobile US said it would be making an investment of $4.8 billion to $5.1 billion towards capital expenditure (Capex) in 2017 – mainly focusing on investment in the expansion of its 4G LTE network.

The telecom operator’s investment in networks has resulted into customer additions. T-Mobile, competing with rivals AT&T, Verizon and Sprint, has achieved 2.1 million net additions in Q4 2016 and 8.2 million in 2016 — for the third year in a row. T-Mobile has a total customer base of 71.5 million. This was the 15th consecutive quarter in which T-Mobile generated more than 1 million total net customer additions.

In 2016, T-Mobile’s capital expenditures, excluding capitalized interest, were $4.6 billion, up from $4.5 billion in 2015. In Q4 2016, capital expenditures of T-Mobile were $0.8 billion.

T-Mobile in Q4 2016

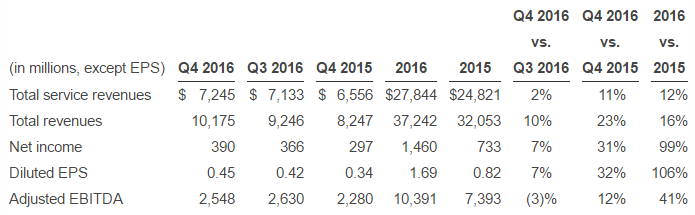

Service revenues $7.2 billion (+11%)

Total revenues $10.2 billion (+23%)

Net income $390 million (+31%)

Adjusted EBITDA $2.5 billion (+12%)

T-Mobile in 2016

Service revenues $27.8 billion (+12%)

Total revenues $37.2 billion (+16%)

Net income $1.5 billion (+99%)

Adjusted EBITDA $10.4 billion (+41%)

T-Mobile gains

T-Mobile said its Un-carrier strategy assisted the wireless champion to capture all of the industry’s postpaid phone growth by adding 3.3 million branded postpaid phone customers in 2016. T-Mobile prepaid added more than 5 million over the past 3 years, including 2.5 million in 2016. T-Mobile also completed its third year of growing service revenues, recording 12 percent growth in 2016 when all of its rivals showed declines.

“These results are proof that doing right by customers is also good for shareholders. Not only are customers flocking to T-Mobile, but we’re also producing rock-solid financial results including 11 percent growth in service revenues, 23 percent in total revenues, 31 percent in net income and 12 percent in Adjusted EBITDA in Q4,” said John Legere, president and CEO of T-Mobile.

The 11 percent increase in service revenues in Q4 2016 to $7.2 billion marks the 11th consecutive quarter that T-Mobile has led the industry in year-over-year service revenue percentage growth.

The 12 percent increase in service revenues to $27.8 billion marks the third consecutive year that T-Mobile has led the industry in service revenue percentage growth.

The 23 percent increase in total revenues in Q4 2016 to $10.2 billion marks the 14th time in the past 15 quarters that T-Mobile has led the industry in total revenue percentage growth.

The 16 percent increase in total revenues to $37.2 billion marks the third consecutive year that T-Mobile has led the industry in total revenue percentage growth.

T-Mobile achieved 31 percent growth in net income in Q4 2016 to $390 million and 99 percent surge to $1.5 billion in 2016.

T-Mobile said the growth in adjusted EBITDA was 12 percent in Q4 2016 to $2.5 billion and 41 percent in 2016 to $10.4 billion.

Investment

T-Mobile, which provides LTE coverage to 314 million people, is targeting 320 million people by the end of 2017.

T-Mobile owned or had agreements to own an average of 86 MHz of spectrum across the top 25 markets in the U.S.

T-Mobile expands its capacity through the re-farming of existing spectrum and implementation of new technologies to support customer growth. At the end of Q4 2016, approximately 70 percent of spectrum was being used for 4G LTE compared to 52 percent at the end of Q4 2015.

T-Mobile expects to continue to re-farm spectrum currently committed to 2G and 3G technologies. Re-farmed spectrum enables T-Mobile to continue expanding Wideband LTE, which currently covers 232 million people.

During Q4 and throughout 2016, T-Mobile has deployed and expanded new technologies like VoLTE, Carrier Aggregation, and 4×4 MIMO that have delivered material capacity benefits to both customers and the T-Mobile network.

Baburajan K

editor@telecomlead.com