Telkom, a leading telecom operator in South Africa, has revealed that capital expenditure (Capex) rose 30.4 percent to R 2,644 million, including R 1,142 million for spectrum, during the six months ended 30 September 2022.

Telkom said its investment has improved capacity and coverage across 7,463 base stations, representing a 5.4 percent in base stations.

Telkom said its investment has improved capacity and coverage across 7,463 base stations, representing a 5.4 percent in base stations.

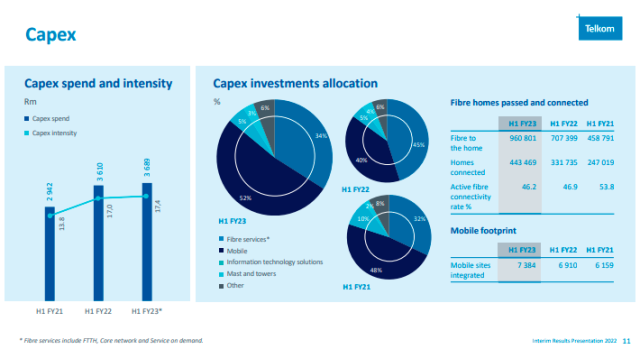

Telkom has earmarked 34 percent of its investment in fiber network, 52 percent in mobile network, 5 percent in IT and 3 percent in telecom towers.

Telkom Group CEO Serame Taukobong said: “Our mobile and broadband strategies continued bearing fruit. We saw good growth in broadband as our data-led and connect-led strategies continued to drive growth in mobile and fibre subscribers along with data usage.”

“Mobile broadband customers comprise almost 62 percent of total active mobile subscribers, while Openserve’s open-access network gained traction as external channels advanced to contribute more than 30 percent of its total revenue.”

Telkom Group revenue grew by 2.3 percent to R 11.031 billion largely driven by growth in active subscribers – mobile and fibre, increased data traffic, higher handset and equipment sales to retail as well as increased IT solutions/equipment to enterprise customers.

South African telecoms group said its third-quarter profit declined by 13.5 percent as crippling power cuts inflated costs and impacted its service revenue. The operator announced a cost savings program to improve profit.

State electricity utility Eskom is implementing the load shedding, leaving households in the dark for up to 10 hours a day, disrupting manufacturing and hurting businesses.

The telecom industry specifically is having to crank up diesel generators to power its vast towers, rollout additional batteries and increase security at these sites to protect them from theft, additional costs that are putting pressure on their margins.

Telkom, majority owned by the government, said group earnings before interest, tax, depreciation and amortization (EBITDA) declined to 2.5 billion rand ($140.10 million) in the third quarter ended Dec. 31, contracting the EBITDA margin by 4.1 percentage points to 22.6 percent.

The blackouts resulted in a year-on-year increase of more than 150 million rand ($8.41 million) of additional costs for the quarter.