TIM Brasil has revealed the financial performance of the company during the second quarter of 2019.

TIM ended the second quarter with 55 million lines, registering a 2.8 percent reduction, the lowest decline in the total base since 2015. This performance represents a slower decline of the base, mainly due to the addition of new M2M lines.

The 4G subscriber rose 16 percent ending with 36.3 million users. The number of handsets in this technology reached 71 percent of the company’s voice base, the larger 4G base in the market.

The M2M and Data Terminals base reached 3.3 million lines (+77.3 percent).

The TIM Live base has 507k clients (+19.7 percent). TIM Brasil’s FTTH business had 27k new users in the quarter and 85k in the past 12 months. TIM Brasil’s FTTH business added five new cities — Duque de Caxias-RJ, Francisco Morato-SP, Franco da Rocha-SP, Camaçari-SP and AnapolisGO. TIM Brasil’s FTTH business covered 33 percent of households.

The company has launched TIM Live Internet, its residential broadband through the mobile network (WTTX), in 22 new cities, expanding to 166 locations.

TIM Brasil revenues were R$ 8.454 billion (+2.1 percent) in the first half of 2019.

Mobile Service Revenues (MSR) reached R$ 3.833 billion (+1.9 percent) during the second quarter of 2019. TIM Brasil’s mobile ARPU rose 5.8 percent to R$ 23.2, mostly influenced by the migration to higher value plans.

TIM Brasil reported fixed service revenues of R$ 230 million (+11.3 percent) in the quarter. TIM Live rose 30.6 percent and accounts for approximately half of fixed service revenues. TIM Live is currently present in 19 cities including 5 capitals. ARPU for TIM Live was R$ 78, 7.8 percent higher than 2Q18.

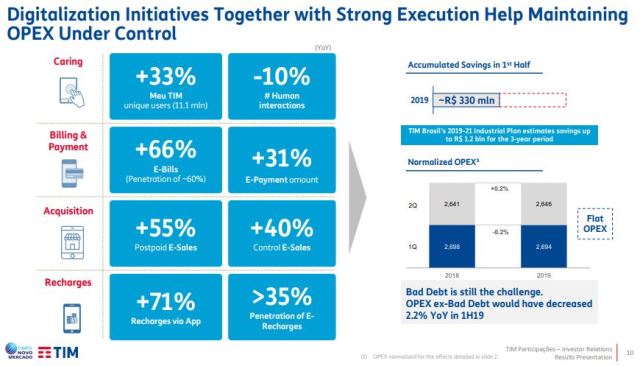

Operating costs and expenses were R$ 1.152 billion (–56.4 percent) in Q2 2019.

TIM Brasil Capex was R$ 945 million (–3.7 percent) in Q2. TIM Brasil focused on making 90 percent of the total investment in infrastructure — mainly projects in IT, transport network and 4G technology through 700MHZ and the refarming of 1.8 GHz and 2.1 GHz. Capex reached R$ 1,595 billion in the first nine months.

TIM Brasil’s 4G network covers 3,321 cities or 93 percent of the urban population. The 40 percent growth in network elements allowed 4G data traffic to reach its highest level during this quarter, making up 81 percent of total data volume. Total sites reached 19,243 units. The mix of units connected via high capacity backhaul maintained 68 percent of the total, while the total for backbone and backhaul fiber optic advanced 8.1 percent, ending the quarter with 92,500km.

On July 23, TIM Brasil and Telefonica Brasil (Vivo) signed a pact for sharing of single-grid 2G network; and establishment of new infrastructure sharing agreements for the 4G network in the 700 MHz, directed to cities with fewer than 30,000 inhabitants.