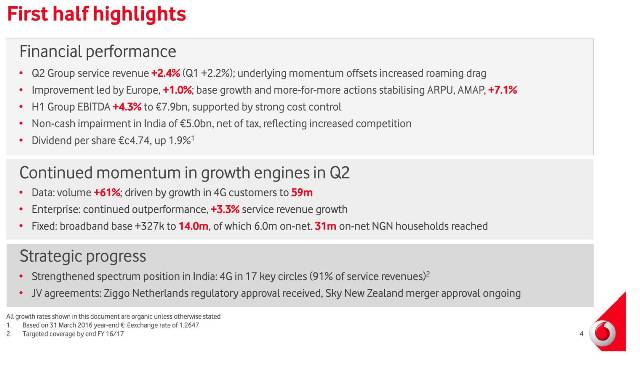

Telecom operator Vodafone Group is strengthening its enterprise business with services to business customers contributing 28 percent of total service revenue in the third quarter 2016.

Telecom operator Vodafone Group is strengthening its enterprise business with services to business customers contributing 28 percent of total service revenue in the third quarter 2016.

Vodafone recently said its enterprise service revenue was €3,447 million (–2.9 percent) in the third quarter. Total service revenue of Vodafone was €12,300 million (–3.2 percent).

Vodafone CEO Vittorio Colao, during Q3 earnings call, said the second engine for revenue growth is its enterprise bsuienss. Enterprise revenue is 28 percent of Group Service revenue and 32 percent in Europe. “Enterprise business leads in 15 out of 20 markets. We have the best 4G IoT footprint in the world. We continue to expand in fixed line with IP-VPNs now in 73 countries,” said Vittorio Colao.

Vodafone CEO Vittorio Colao, during Q3 earnings call, said the second engine for revenue growth is its enterprise bsuienss. Enterprise revenue is 28 percent of Group Service revenue and 32 percent in Europe. “Enterprise business leads in 15 out of 20 markets. We have the best 4G IoT footprint in the world. We continue to expand in fixed line with IP-VPNs now in 73 countries,” said Vittorio Colao.

Vodafone IoT

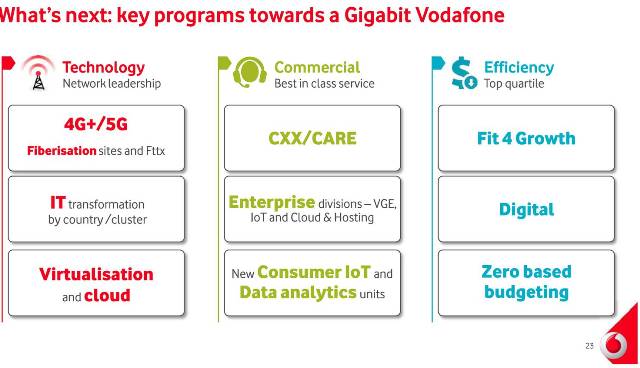

Vodafone Group has decided to launch a consumer IoT division by 2020, and to strengthen its data analytics unit. Global telecom operators such as Verizon and AT&T are already reaping benefits from their IoT business.

Vodafone said its IoT connections increased 38 percent to 49.1 million.

Vodafone will have 5G footprint and a strong IoT revenue in coming years when it really utilizes the opportunities from “Gigabit Vodafone approach.”

Vodafone noted that fixed market share gains and mobile services to enterprises in AMAP were the drivers for the growth in enterprise business.

Sales from mobile voice and data connectivity, communications, IoT, Cloud & Hosting and IP-VPN provision are some of the major components of Vodafone’s enterprise revenue. These new areas offer both market growth and market share opportunities to Vodafone.

In fact, enterprise revenue is offsetting ARPU pressure in mature European mobile markets. Services to business customers comprised 32 percent in Europe in Q3.

Vodafone Global Enterprise (VGE), which provides services to large international customers, posted slower growth in the third quarter reflecting increased competition in India and customer losses in the fixed market in the UK.

Regional performance in enterprises

Vodafone said its UK service revenue declined 3.2 percent, reflecting competition in enterprise and lower MVNO revenues.

Vodafone UK’s mobile service revenue fell 3.9 percent due to price competition in enterprise during the quarter, as well as lower MVNO and roaming revenues. Vodafone UK lost 125,000 customers during the quarter. Vodafone UK had 9.1 million 4G customers, with 4G coverage at 97 percent.

Fixed service revenue of Vodafone UK fell to 0.9 percent in Q3 against a drop of 2.9 percent in Q2. Vodafone UK had 183,000 broadband customers by the period end, of which 129,000 are consumer customers (an increase of 32,000 in Q3).

Vodafone Germany’s service revenue grew 1.8 percent driven by strong fixed customer growth and an improved performance in branded consumer mobile.

Drop in enterprise ARPU of Vodafone Germany has moderated, while consumer contract ARPU is stabilizing. Vodafone Germany started offering download speeds of up to 375Mbps in 27 cities, with 1Gbps available in pilot areas. 4G customer base of Vodafone Germany was 9.9 million by the period end.

Vodafone Germany’s fixed service revenue increased 4.8 percent, driven by growth in both DSL and cable business. Vodafone Germany added 110,000 broadband customer including 77,000 on cable and the balance on DSL. Vodafone Germany’s coax-fibre cable network reaches over 6 million households with speeds of up to 400Mbps, as well as supplies TV to 7.8 million customers.

Vodafone Netherlands service revenue declined 6.4 percent, reflecting a lower mobile consumer customer base and increased competition in enterprise.

Vodafone Turkey’s service revenue rose 15 supported by growth in consumer contract and enterprise and an increased contribution from fixed.