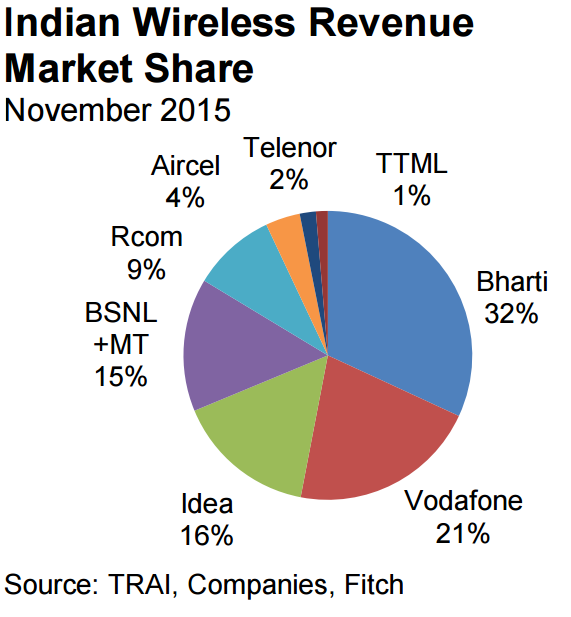

Fitch Ratings predicted that Indian telecoms Bharti Airtel, Vodafone, Idea Cellular and Reliance Communications may increase their revenue market share to 80 percent in 2016 from 77 percent in 2015.

This is primarily because of the anticipated exit of loss making telecoms such as Videocon Telecom, Tata Docomo and Aircel utilizing their valuable, but under-utilized spectrum. Russian business house Sistema is already in the process of exiting from Indian telecom market by selling MTS India to Anil Ambani-promoted Reliance Communications.

Reliance Jio challenges

Bharti Airtel, Vodafone, Idea Cellular and Reliance Communications will be under pressure from the Mukesh Ambani-promoted Reliance Jio Infocomm. Reliance Jio is threatening the established mobile operators in the mobile Internet space. Incidentally, mobile data is the lifeline for all telecoms in the India that has nearly 900 mobile subscribers with an ARPU of $2 to $4 per month.

Reliance Jio Infocomm is likely to launch its cheaper and faster 4G—focussed data services in Q1 of 2016 — having invested about $14 billion — partly to acquire 800 MHz spectrum in 10 circles and higher — bandwidth spectrum of 2300MHz/1800MHz in 22 circles.

As a result, Fitch Ratings said it expects the 2016 credit profiles of the top-four Indian telecoms to come under pressure amid tougher competition, larger Capex requirements and debt-funded M&A. Fitch Ratings says the outlook of Indian telecoms will be negative in 2016 from stable in 2015.

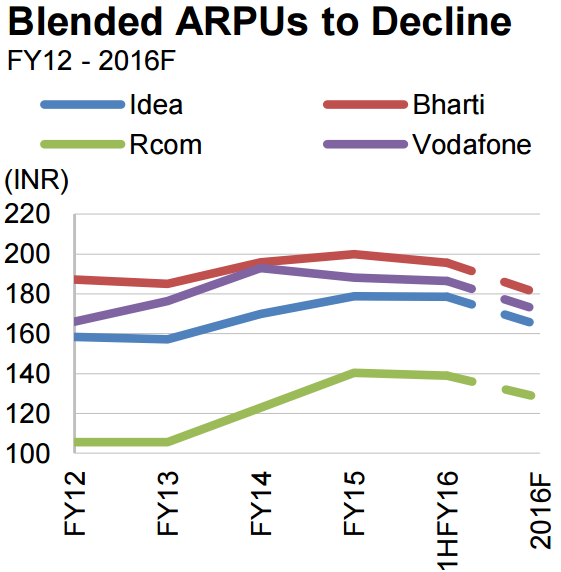

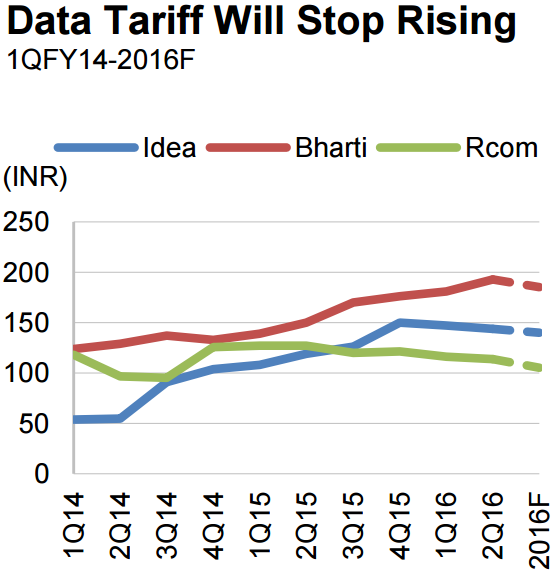

The blended tariff will dip 5-6 percent as Reliance Jio Infocomm’s entry will arrest the rise in data ARPU despite rising data usage, and as voice ARPU will continue to fall due to cannibalization by data.

Sunil Bharti Mittal, chairman of Bharti Airtel, has already admitted that the entry of Reliance Jio will put pressure on Indian telecom operators thanks to unprecedented scale of the 4G player.

Vodafone India CEO does not bet big on 4G operations and plans a limited entry into LTE next year. Idea Cellular plans 4G coverage in 600 towns in H1.

“We expect industry revenue to grow by the low-single-digits in 2016 against 9 percent in 2015, driven solely by data services as voice matures and subscriber growth slows,” said Fitch Fitch Ratings in a statement.

Contribution of data to revenue will increase to around 25-27 percent from 18-20 percent in 2015 as data traffic will double.

Average operating EBITDA margin of Airtel, Vodafone, Idea Cellular and Reliance Communications will decline by 100bp-200bp from 35 percent in 2015 due to pricing pressure on the higher-margin data services and a rise in marketing spend as data competition rises.

Fitch Ratings has assigned BBB/Stable rating to Bharti Airtel, while Vodafone India, Idea Cellular and Reliance Communications will have BB-/Stable rating.

Reliance Jio, according to industry predictions, will be the leader in 4G market. But it will not be a dominant 4G operator since Vodafone, Idea Cellular and Airtel will have considerable presence in the 4G market. But the financial health of established players is bleak. It will affect the roll out of fresh networks.

It will be a bad news for telecom network vendors such as Ericsson, Alcatel-Lucent, Nokia Networks, Huawei and ZTE.

Capex to increase?

Telecoms’ Capex (capital expenditure) to revenue ratio could rise to 19-20 percent in 2016 from 18 percent in 2015. Telecoms will be investing to improve data business and meet challenges from new competitor Jio. Telecoms will also invest to improve voice call quality.

Airtel is expected to make an investment of around $3.4 billion to support 3G / 4G services, address call drops and to strengthen the African network infrastructure.

Baburajan K

[email protected]