Improvement in mobile network experience is resulting into less churn of smartphone customers at telecom operators in India, Opensignal said.

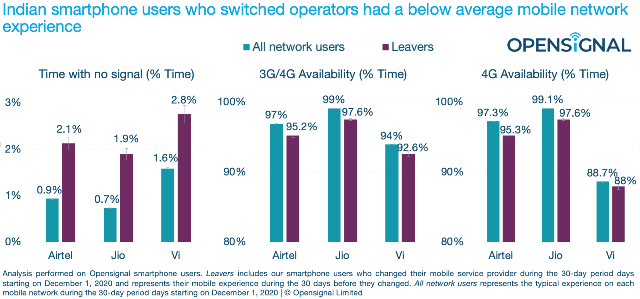

Smartphone users on the three leading telecom networks, who changed their mobile service provider, had a worse experience before they switched compared to the typical mobile experience on their original network.

Smartphone users on the three leading telecom networks, who changed their mobile service provider, had a worse experience before they switched compared to the typical mobile experience on their original network.

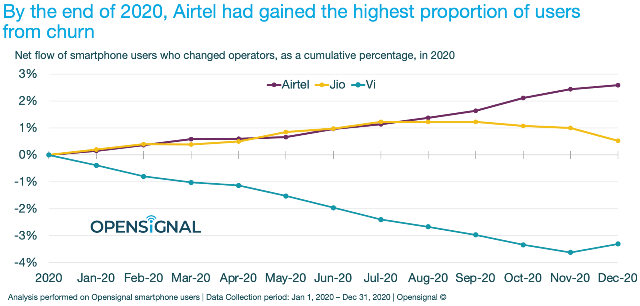

Opensignal report said Vi (Vodafone Idea) lost subscribers to churn compared to its rivals — Airtel and Jio — who gained new subscribers. By the end of 2020, Airtel had gained the highest proportion of users in 2020.

Opensignal analyzed the mobile experience of smartphone users who changed their mobile network service provider (Leavers) in 2020 after all three leading operators raised the tariffs.

Airtel gained users until the end of the year. However, that trend on Jio’s network more or less flattened and then gradually started to decline — the negative trend was more pronounced from mid-November onwards.

In contrast, Vi had steadily lost customers since the beginning of the year and only started to see a deceleration of this trend from mid-November onwards.

Opensignal, which analyzed the mobile experience of smartphone Leavers for the month of December 2020, found that smartphone Leavers had a worse mobile experience before they switched than the typical experience observed by smartphone users on their original network provider.

Leavers across Airtel, Jio and Vi spent between 74 percent and 155 percent more time without a mobile signal compared to the average scores on their networks; they also spent less time connected to either a 3G or 4G mobile connection — 3G/4G Availability — and they experienced lower 4G Availability, the report said.

Airtel has added 4.1 million / 5.5 million gross / active subscribers at 339 million / 329 million in Dec 2020. Airtel has regained its top spot in terms of active subscriber market share (SMS) at 33.7 percent. The quality of Airtel’s subscribers is reflected in its strong 4G subscriber additions of 4.4 million vs Jio’s additions of 0.5 million, taking up 94 percent incremental SMS, a report from Motilal Oswal said.

Airtel has added 4.1 million / 5.5 million gross / active subscribers at 339 million / 329 million in Dec 2020. Airtel has regained its top spot in terms of active subscriber market share (SMS) at 33.7 percent. The quality of Airtel’s subscribers is reflected in its strong 4G subscriber additions of 4.4 million vs Jio’s additions of 0.5 million, taking up 94 percent incremental SMS, a report from Motilal Oswal said.

Jio’s monthly gross / 4G subscriber additions have slowed to 0.5 million in Dec 20 at 409 million vs 1.9 million in Nov 2020 and an average of 7 million in FY20. Active subscriber additions were better at 3.2 million (but slower than 5.4 million in Nov 2020) in Dec 2020. Jio maintained its top spot in gross SMS at 35.4 percent.

The pace of gross / active subscriber loss for Vi continues at 5.7 million / 1.5 million in Dec to 284 million / 257 million — after a loss of 2.9 million / 1.9 million in Nov. This is a key red flag as the 3QFY21 result positively hinted at slower deceleration.