Uninor, the Indian subsidiary of telecom operator Telenor, has started facing struggle in the Indian data market — dominated by Vodafone, Bharti Airtel, Idea Cellular, etc.

The challenge will aggravate if Reliance Jio Infocomm and Bharti Airtel start adding 4G LTE subscribers by offering the high end Internet on smartphones at 3G prices or less.

The main challenge of Telenor in India includes the absence of spectrum to roll out 3G and enough spectrum for seamless 4G experience. Uninor is currently planning to test narrow band 4G services using its limited spectrum. Incidentally, 4G is becoming a focus area for Telenor in European telecom markets.

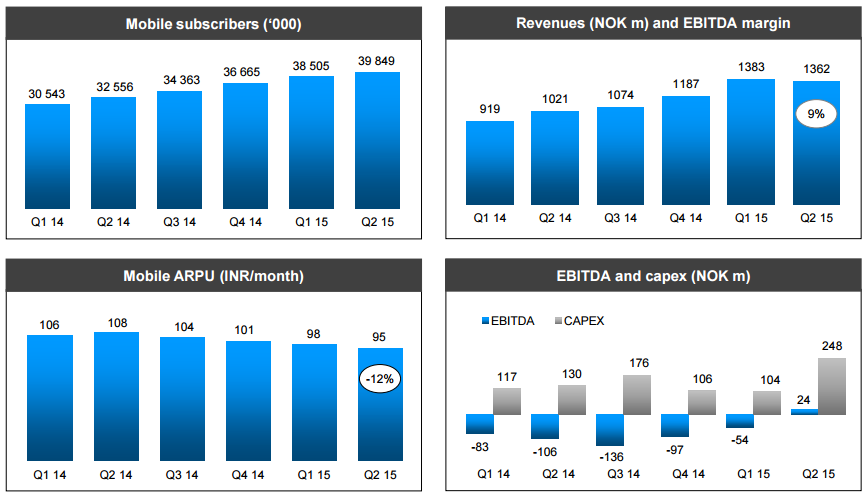

Telenor last month said that the ARPU of Uninor dropped 12 percent to Rs 95 in the second quarter of 2015 from Q2 2014 – mainly driven by lower voice consumption and the impact from reduced mobile termination rate, partly compensated by increased data usage.

The ARPU of Uninor declined to Rs 95 in Q2 2015 from Rs 98 in Q1 2015, Rs 101 in Q4 2014, Rs 104 in Q3 2015, Rs 108 in Q2 2014 and Rs 106 in Q1 2014.

For comparison, the growth in ARPU of Bharti Airtel was flat at Rs 198 in June 2015 quarter against Rs 198 in March 2015 quarter, but fell from Rs 202 in June 2014 quarter.

Uninor does not share specific details on data ARPU.

The data ARPU of Bharti Airtel increased to Rs 181 in June 2015 quarter from Rs 176 in March 2015 quarter and Rs 139 in June 2014 quarter.

Data customer base of Bharti Airtel increased to 49,470,000 from 46,386,000. 3G user base of Airtel jumped to 21,360,000 from 19,441,000. The Telenor subsidiary does not have 3G license in India to offer high end mobile Internet.

“We are giving an offer on 2G only which is data protocol which is slow in the longer run. 2G data works for the customers that have their initial taste of data. We are broadening the market but we’re also educating the market for later in broader usage,” Jon Fredrik Baksaas, president and CEO of Telenor, who recently stepped down, said last month.

“We don’t have sufficient spectrum for a complete data offering down the line. In the longer run it needs to be complemented with spectrum that can offer better bandwidths,” Baksaas said.

Mobile user base of Uninor increased to 39.84 million in Q2 2015 from 38.5 million in Q1 2015, 36.66 million in Q4 2014, 34.36 million in Q3 2015, 32.55 million in Q2 2014 and 30.54 million in Q1 2014.

Revenue of Uninor decreased to NOK 1362 million in Q2 2015 from NOK 1383 million in Q1 2015, but rose from NOK 1187 million in Q4 2014, NOK 1074 million in Q3 2015, NOK 1021 million in Q2 2014 and NOK 919 million in Q1 2014.

Uninor indicated the current spectrum would be enough for 2016 and 2017.

“The speed of data adoption in the Indian market will gradually gives us more vulnerability on how we resolve the data offerings. We’re exploring the idea of splitting our frequency base into one data part and one voice part,” said Baksaas.

As part of Telenor’s strategy “Internet for all”, Uninor launched Internet on Wheels. These are vans moving around the circles with trained staff spreading the awareness around benefits of Internet and mobile. It also takes the retail stores to the doorsteps of the customer.

Uninor has more than 376,000 point of sales and around 1,700 branded retail outlets.

Baburajan K

[email protected]