China’s surge into 5G will push global smartphone market back to growth in 2020, says the new report from IDC.

The U.S., Korea, United Kingdom, and Canada are the other key markets that will drive the smartphone growth, which is expected to grow 1.5 percent year over year in 2020.

IDC expects shipments volumes just over 1.4 billion in 2020, of which 190 million will be 5G smartphones, accounting for 14 percent of total smartphones shipped, which far exceeds the first year of 4G shipments (2010) at 1.3 percent.

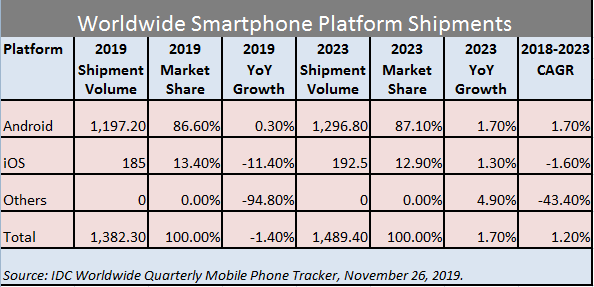

Android’s smartphone share will increase to 86.6 percent in 2019 from 85.1 percent in 2018 mostly due to 5G launches and expanded product portfolios of global Chinese players. Volumes are expected to grow at a five-year CAGR of 1.7 percent with shipments of 1.3 billion in 2023.

Meanwhile 2019 will remain a challenging year for iPhone shipments with volumes expected to drop to 185 million, down 11.4 percent year over year, mostly due to stressed market headwinds as well as a lack of 5G devices. However, Apple is likely to deliver 5G handsets later in 2020, which will pick up iOS volumes slightly.

5G smartphone prices for both hardware and services are also expected to come down quickly in order for this market segment to grow, according to IDC.

Android vendors are expected to drive down the cost of 5G smartphones starting with an abundance of first quarter announcements at both CES and MWC. Apple’s entrance into the 5G smartphone market is highly anticipated for a September 2020 announcement with the real focus around pricing and market availability.

“Recent developments in the China market along with anticipation of aggressive activity from the smartphone supply chain and OEMs have caused us to raise our short-term 5G forecast,” said Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Trackers.

“Apart from the expected rapid 5G growth in China, we also can’t miss watching other markets such as Australia, Japan, and Korea in Asia/Pacific as well as some European countries that have picked up 5G slower than predicted,” said Sangeetika Srivastava, senior research analyst with IDC’s Worldwide Mobile Device Trackers.