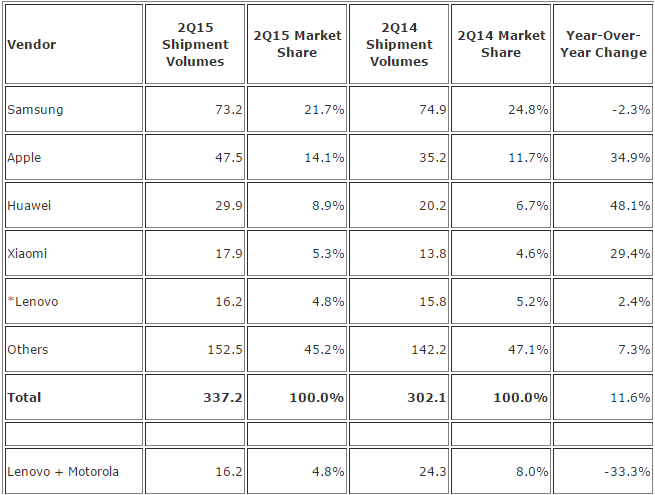

IDC today said the smartphone shipment of Samsung has declined to 73.2 million in Q2 2015 from 74.9 million in Q2 2014. Apple shipments rose to 47.5 million from 35.2 million.

Smartphone shipment of Huawei incresed to 29.9 million from 20.2 million.

Xiaomi achieved smartphone shipment of 17.9 million against 13.8 million.

Lenovo + Motorola shipped 16.2 million as compared with 24.3 million, said IDC.

Smartphone shipments rose 11.6 percent to 337.2 million smartphones in the second quarter of 2015 from 302.1 million units in Q2 2014.

Shipment of mobile phones — inclusive of smartphones – fell 0.4 percent to 464.6 million units from 466.3 million units.

Anthony Scarsella, research manager with IDC’s Mobile Phone team, said though premium handsets sold briskly in developed markets, it was emerging markets, supported by local vendors, driving the momentum that heavily contributed to the second highest quarter of shipments on record.

The report said Samsung was the only company among the top five to see its shipment volume decline. The Galaxy S6 and S6 edge received mixed response due to limited supply of the edge models. Samsung sold older Galaxy models after offering huge discounts and promotions. The release of the pending Note 5 and S6 edge plus will determine the future market share of the Korean smartphone maker.

Apple iPhone dominated in China due to the demand for the larger screened iPhones along with the rapid expansion of 4G networks in China. Apple will look to drive upgrades with refreshed S models in the following quarter.

Huawei captured the number 3 position thanks to strong European sales as well as domestic sales that led to 48.1 percent growth. Huawei’s P8, Honor Series, and Mate 7 handsets deliver sustainable growth both in the consumer and commercial segment, said IDC. Huawei will look beyond Europe and Asia Pacific as its latest P8 Lite handset launched in the U.S. as an unlocked model for $250 earlier in the quarter.

Xiaomi with Mi Note and Redmi 2 handset models achieved 29.7 percent increase. With a significant presence in India and Southeast Asia, Xiaomi is now looking to other smartphone markets, starting with Brazil.

Lenovo faced home turf competition from both Xiaomi and Huawei. Lenovo achieved success in many emerging markets such as India with entry-level and mid-range models like the A600 and A7000, sold via Internet retail channels.

Baburajan K

[email protected]

Baburajan K

[email protected]