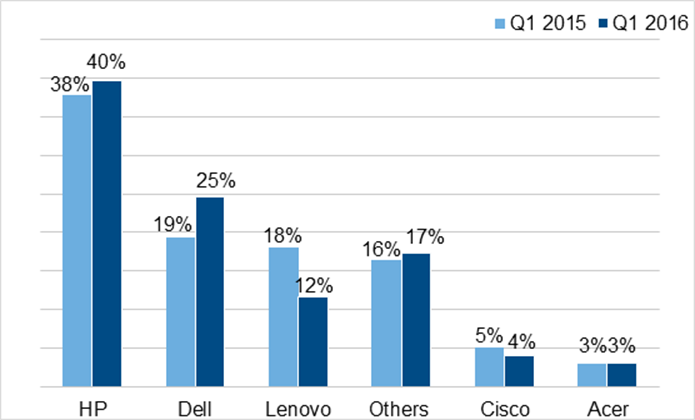

IDC has shared the server market share report for India for Q1 2016. HPE is the market leader in the Indian server market.

HPE has 40 percent market share in terms of unit shipment, followed by Dell with a market share of 25 percent in the India x86 market.

Lenovo’s market share dropped from 18 percent to 12 percent. White box providers lost share from 12 percent in Q1 2015 to 11 percent in Q1 2016. Cisco’s market share dropped 1 percent, while Acer retained its market share at 3 percent.

HP has 46 percent sever market share in terms of revenue, followed by Dell at 27 percent market share. Lenovo’s market share stood at 8 percent in Q1 2016, closely followed by Cisco at 7 percent.

Server market increases

Server market in India rose 21.6 percent to 40,495 units in Q1 2016 against 33,292 units in Q1 2015. Server market revenue increased 27.8 percent.

Investments from telecom service providers towards 4G deployments, investments from hosting providers and banking refreshes primarily contributed to the growth in server market. The drive for digitization across multiple verticals and cities was the factors. Ongoing smart cities initiatives and surveillance projects further propelled compute demand nationwide.

The non x86 server market grew 15.3 percent to in unit shipments and 42.4 percent in revenue in Q1 2016. Banking and Communications & Media verticals were the contributors to this growth, owing to several bank refreshes and continued investments from telecom providers.

“With the launch of AWS data centres in India, the cloud services space in India is expected to get more competitive, price cuts more dramatic and compute demand more imperative,” said Ruchika Kakkar, server market analyst at IDC India.

Server market forecast

Investments from global cloud service providers and a few e-commerce players are expected to drive server demands in the next two quarters. Banking refreshes and digitization across various verticals are expected to augment server demand. Government backed surveillance and Digital India projects across multiple states remain in the pipeline, with further investments expected in the near future, said IDC.