Global smartphone wholesale revenue increased 37 percent to pass $100 billion in the first quarter of 2021, according to the latest research report from Strategy Analytics.

The lengthened Apple iPhone 12 super cycle, supply shortages and component price spikes, faster-than-expected 5G smartphone adoption, and industry consolidation all combined to deliver a much-needed positive quarter.

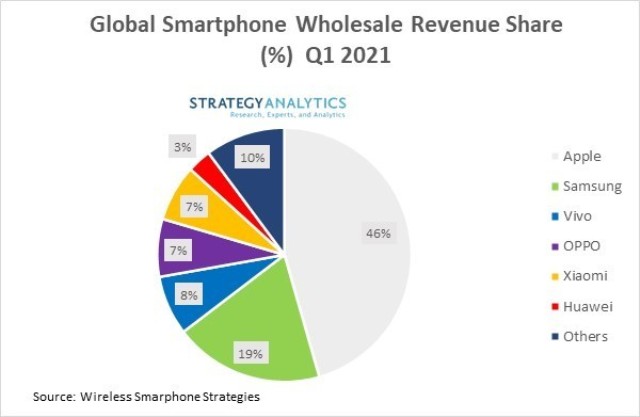

Apple and Samsung are front runners in revenue terms.

Vivo surpassed Huawei and moved to the third place.

Vivo took 8 percent revenue share from 5 percent one year ago. Oppo and Xiaomi each captured 7 percent share of the global smartphone revenue.

The global smartphone market is remarkable with 25 percent of revenue coming from super premium devices with wholesale prices above $900. Apple and Samsung dominate these hugely profitable segments.

Vivo is ranked first in the $400 to $499 wholesale band, while Oppo led in the $191 to $299 range in Q1 2021.

Transsion maintained the leadership in entry tier (US$36 to $99) this quarter.

The super-premium category where the top flagships from Apple and Samsung have almost total control offers great brand halo benefits, but is quite small at only 25 million units in Q1 2021.

Challenger brands like Xiaomi, Oppo, Vivo and others will battle for volume and prominence in the mid and high tiers, which collectively account for almost half of smartphone shipments.

“Offering flagship devices with top notch features and technologies in select models along with major sponsorships, brand ambassadors and technology partners is a winning long-term formula,” David Kerr, Senior Vice President at Strategy Analytics, said.