Ian Fogg, senior director, mobile and telecoms, IHS Markit, has revealed the performance of top 10 smartphone brands in 2017.

The worldwide top 10 smartphone manufacturing companies are Apple, Samsung, Huawei, Xiaomi, OPPO, vivo, LG, Motorola / Lenovo, ZTE and TCL-Alcatel. Indian brands such as Micromax, Karbonn, Lava, Reliance Jio, among others did not find a place in the top 10 list for global smartphone brands.

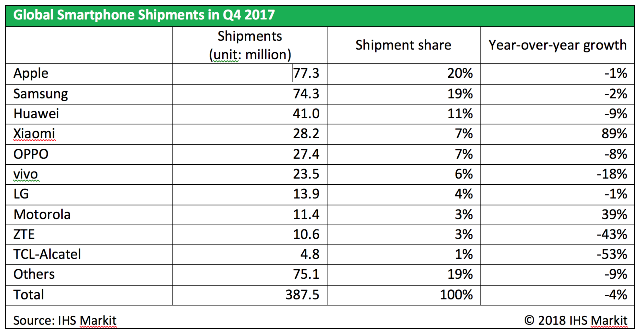

Smartphone unit shipments grew 3.1 percent to 1.44 billion units unit in 2017 and fell 4.5 percent to 387.5 million units in the fourth quarter of 2017.

Only Xiaomi and Motorola experienced shipment growth in Q4 2017.

Apple shipped 77.3 million units (–1.2 percent) for grabbing 20 percent of the worldwide smartphone market share.

Samsung’s smartphone shipments were 74.3 million units (–2.2 percent) for 19 percent share, which was down from 23 percent the previous quarter.

New devices helped Apple push its average selling price (ASP) to $796, which is $101 higher than the previous year.

Samsung, Korea-based electronics company, has spent more in marketing to sell its devices, affecting the profits for its IT and mobile communications division.

The turn toward more value-added handsets helps Samsung avoid direct competition with Chinese players in low-end price segments, which often come with lower or even negative profit margins.

Samsung’s strategy to bring its S9 Galaxy S model in February 2018 and start sale in March should boost Samsung’s product mix and ASP. Samsung launched the S8 in late March last year, with sales starting in April.

Xiaomi shipped 28.2 million units (+89.2 percent) — driven by strong results in India. Xiaomi added its share of global smartphone unit shipments, from 4 percent in 2016 to 7 percent in 2017.

Huawei’s smartphone shipments were 40.9 million (–8.6 percent). Huawei smartphone shipments contracted on a year-over-year basis – for the first time. Huawei shipped fewer than 200,000 units to the US in Q4. Huawei is facing security related challenges in the US market that is dominated by Apple and Samsung.

OPPO smartphone shipments touched 27.4 million units (–8 percent).

Vivo shipped 23.5 million units (–18 percent) in the fourth quarter.

LG Electronics shipments were 13.9 million units (–1.4 percent).

Lenovo’s shipments of Motorola-branded devices rose 39.5 percent to 11.4 million units in the fourth quarter. Motorola controlled 3 percent of shipments in the fourth quarter, compared to Lenovo, which fell to 1 percent of shipments.

Lenovo will continue to phase out Lenovo-branded handsets, focusing exclusively on the Motorola brand in most markets.

ZTE faced 42.5 percent decline in shipments to 10.6 million units for 3 percent market share. ZTE expanded in US carriers, launching Axon M device in association with AT&T.

Gerrit Schneemann, senior analyst, mobile location and mobile devices, IHS Markit; and Jusy Hong, principal analyst, mobile devices and mobile media, IHS Markit predict that many smartphone brands will experience changes in 2018.

Google and HTC completed their deal to transfer personnel and IP from HTC to Google, and LGE’s smartphone business will continue to drag down the company’s overall performance. Other brands also face hard decisions over the next few quarters.