Wireless Capex (Capital expenditure) of Tier 1 U.S. operators fell 1.8 percent year-to-year to $7.6 billion in Q2 2017.

Wireless Capex (Capital expenditure) of Tier 1 U.S. operators fell 1.8 percent year-to-year to $7.6 billion in Q2 2017.

This was a major setback for leading telecom network companies such as Ericsson, ZTE, Huawei, Cisco, Nokia, IBM, HPE, Dell, Oracle, among others. Technology Business Review says network companies will be giving thrust on webscale companies because of their massive Capex programs.

All Tier 1 U.S. carriers except Sprint has lowered telecom network spending in the second quarter as less investment is required for LTE deployment with the bulk of network construction complete. Sprint, a part of SoftBank, needs to invest more because of its plans to enhance customer experience and customer additions. Sprint is the fourth largest telecom operator in the U.S.

A report from TBR said carriers are spending on additional capacity for their LTE networks to support their unlimited data plans.

AT&T, Verizon, T-Mobile and Sprint are making investment in small cells and deploying services on new spectrum. Improvement in data speeds by integrating LTEAdvanced technologies such as multi-channel carrier aggregation is also one of the focus areas.

Carriers are also preparing for the launch of 5G services over the next several years by investing in high-band spectrum, fiber backhaul and small cells.

US revenue

US revenue

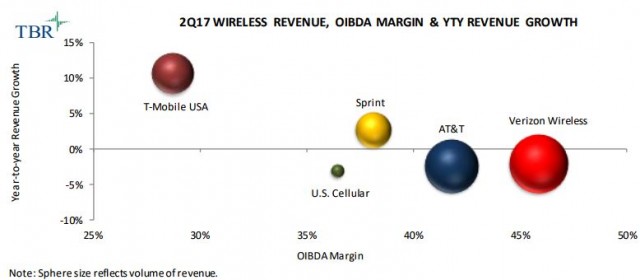

Wireless revenue of US telecom operators increased 0.6 percent year-to-year to $57.8 billion Q2 2017.

Growth was driven by T-Mobile’s higher service revenue, buoyed by 1.3 million subscriber additions, as well as most U.S. carriers increasing equipment revenue in the quarter via device installment plans.

Sprint and T-Mobile benefit from their leasing programs as they generate equipment revenue from the residual value of returned smartphones as well as reselling the devices to third parties.

Technology Business Research said most carriers are struggling to increase service revenue due to the discounts given to customers on non-subsidized pricing plans as well as operators relying on aggressive pricing promotions to attract customers.

Verizon’s and AT&T’s new unlimited data plans, which launched in February, helped drive a year-to-year increase in the carriers’ postpaid phone net additions due to enhanced customer flexibility and video streaming capability.

TBR Analyst Steve Vachon said Tier 1 U.S. carriers other than Sprint improved postpaid phone churn year-to-year as adoption of unlimited data plans, along with improved network coverage, is retaining subscribers.

Adoption of unlimited data plans had mixed results on service revenue. Though the plans benefit ARPU, as customers migrate from lower-priced data plans, they also hamper ARPU by reducing overage revenue.

Canada revenue

Combined wireless revenue among Tier 1 Canadian carriers rose 7.9 percent year-to-year to $5.9 billion due to continued postpaid additions spurred by shared data programs and higher data usage arising from the accelerated speeds offered by LTE-Advanced services.

Bell Mobility, Rogers and Telus increase service revenue as the carriers sustain consistent postpaid net additions and higher data usage.

Though Tier 1 Canadian carriers continue to increase ARPU through customers migrating to larger data tiers, the companies are launching regional pricing promotions to counter offers from smaller carriers such as Quebec’s Videotron.

The Tier 1 carriers also recently launched pricing promotions targeted at Shaw’s Freedom Mobile brand, which is expanding its LTE network to additional markets in Canada.