There’s significant confusion on the superiority of 5G among the early adopters of 5G services because 5G is at present available in different formats – hotspot, fixed wireless broadband and mobile.

The messages coming from US operators such as Verizon and AT&T are indicating that 5G has not yet reached anywhere. At least, there is no long queue to buy 5G connections in the US or South Korea.

“Fewer people understand the iterative nature of major technology rollouts such as the one we are going through now with 5G — a process involving multiple major updates that will add new capabilities in the coming years,” Francis Sideco, vice president, technology at IHS Markit, said.

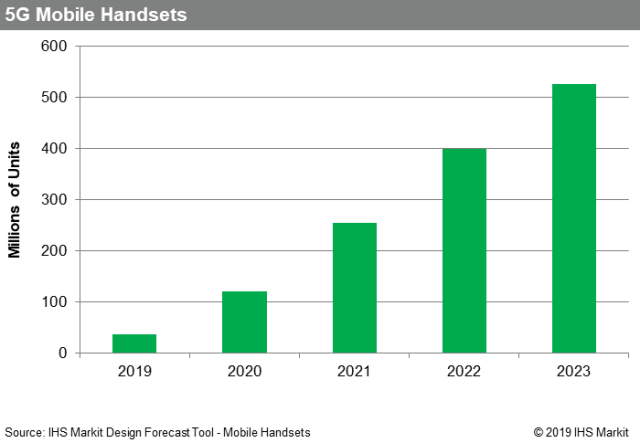

Sale of first-generation 5G smartphones will reach 37 million this year, 120 million in 2020 and 525 million devices in 2023, IHS Markit forecasts.

5G confusion

At present, the US and Korea are waging a battle to say we are leading in the 5G market in terms of actual commercial launches. Consumers do not find enough comfort in buying a 5G connection as a part of their home broadband or hotspot or a 5G-enabled phone. They need a cost effective 5G smartphone which will work on all commonly available bands with enough roaming access.

At least 211 mobile operators are making investments in various 5G programs in 87 countries.

The IHS Markit report indicates operators and consumers need to wait for some more time as the next phase of 5G will be ready in 2020 or 2021.

This is because of the 5G standard’s next release — Release 16 – will be ready in late 2019 only. The release will deliver highly desirable enhancements, including far greater reliability and peak data rates of 20 gigabits-per-second (Gbps) downlink and 10 Gbps uplink.

Each of these updates will have the potential to significantly disrupt the market’s competitive dynamics.

This next phase of 5G network rollout will trigger a race among mobile network operators to meet and take advantage of these performance enhancements.

Future revisions in 5G standards will spur similar competitive battles, as 5G adds major new capabilities and expands into other markets beyond mobile communications, such as mission-critical applications and massive internet of things (IoT) deployments.

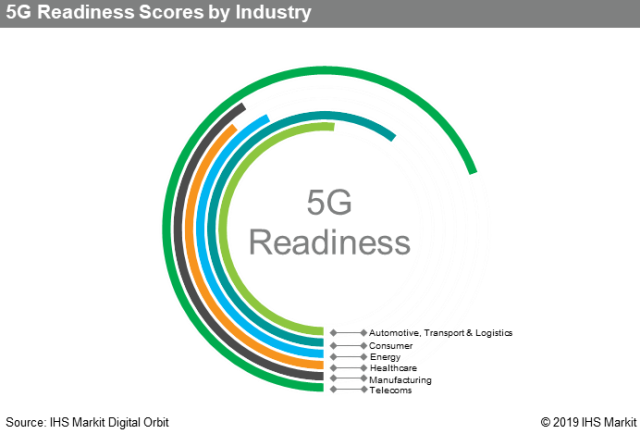

A recent GSMA report indicated that operators should target enterprises with their 5G service because 5G networks will bring more business opportunities to them. Consumer focus should be the second priority for 5G operators.

5G will improve existing mobile services and enable new use cases, such as driverless cars, immersive entertainment, zero-delay virtual reality, uninterrupted video and no-latency gaming.

IHS Markit said 5G will be key to expanding and realizing the full promise of the internet of things (IoT), with the technology’s impact to be felt in smart homes, smart cities and smart industries.

The latest IHS Markit report said the confusion is negatively impacting smartphone consumers and complicating the industry’s ability to measure itself against a standard set of 5G expectations and requirements.

Baburajan K