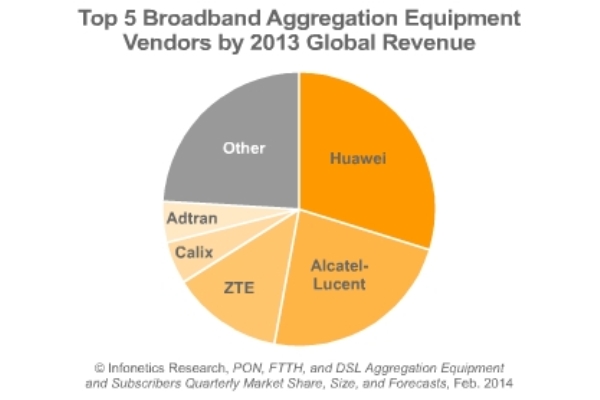

Huawei, Alcatel-Lucent, and ZTE are the leading vendors in the broadband aggregation revenue market in 2013, said Infonetics Research. Adtran and Calix are the other top two broadband equipment vendors.

The report said sales of broadband aggregation equipment (DSL, PON, and Ethernet FTTH) grew 4.6 percent sequentially in Q4 2013 to $1.95 billion.

In 2013, broadband aggregation equipment revenue rose 1.6 percent to $6.96 billion.

FTTH growth in China assisted Huawei to maintain lead. 2013 capped a record year for GPON in China, with revenue increasing 64 percent from the previous year as China Unicom and China Telecom continued deployments of GPON-based FTTH

VDSL shipments surpassed ADSL for the first time in 2013 and now make up over half of all DSL ports shipped, though this was not enough to lift overall DSL aggregation market on a year-over-year basis, said Infonetics Research.

“2013 ended up being a strong year for fixed broadband spending, driven by the continued growth of GPON and vectoring-capable VDSL gear. Competition, over-the-top (OTT) and multiscreen video, and national broadband goals remain the primary drivers for fixed broadband investment,” said Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics Research.

Ovum on broadband equipment market

In a February 25 research note, Ovum said the wireline broadband access equipment market dipped 23 percent to $5.42 billion last year. DSL equipment revenues declined 28 percent as the decline in ADSL was not offset by VDSL. PON equipment revenues were down by 24 percent, reflecting the lack of a major, new FTTH deployment.

For the total broadband access equipment market, Alcatel-Lucent led the gainers followed by Cisco and Adtran. ZTE posted the largest loss in market share. Huawei maintained its dominant position with 28 percent market share, said Ovum.