Vodafone, as part of its cable and broadband strategy, announced its $21.8 billion deal with Liberty Global to buy operations in Germany, the Czech Republic, Hungary and Romania.

The strategy of Vodafone Group is to enhance its revenue from cable and fixed line phone business in Europe and leverage Capex and Opex synergies.

Vodafone is expected to pay approximately €10.8 billion in cash to Liberty Global, while the balance €7.6 billion will be the existing debt. The enterprise value of the deal will be €18.4 billion or or $21.8 billion, Vodafone said.

Earlier, Liberty Global announced the sale of UPC Austria for €1.9 billion to T-Mobile Austria, aiming to close in the second half of 2018.

Vodafone and Liberty already have a joint venture in the Netherlands. Liberty will continue to own the Virgin Media network in Britain.

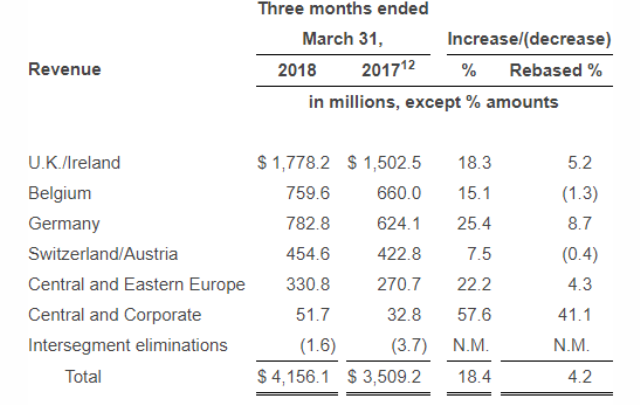

Liberty Global posted revenue of $4.156 billion (+4.2 percent) in the first quarter of 2018. The above chart indicates revenue of Liberty Global in different markets / regions in the first quarter of 2018.

Liberty Global posted revenue of $4.156 billion (+4.2 percent) in the first quarter of 2018. The above chart indicates revenue of Liberty Global in different markets / regions in the first quarter of 2018.

Liberty Global generated revenue of $782.8 million from Germany, $330.8 million from central and eastern Europe and $51.7 million from Central Europe and $454.6 million from Switzerland / Austria.

The world’s second-largest mobile operator held repeated talks with John Malone’s Liberty Global in recent years in a bid to broaden its offering and better compete in Europe with former monopolies such as Deutsche Telekom, Reuters reported.

Vodafone will get access to 54 million homes on its cable and fiber network and enable it to cross sell a range of services to those customers, while also taking out costs.

Earlier, Vodafone purchased Ono, a cable operator in Spain, to help the group meet customer demand for a single package of fast communications services

The Reuters report indicates that the cable deal is likely to face a lengthy regulatory approval process, with rivals such as Deutsche Telekom arguing that it will give Vodafone too much control of the market.

The deal accelerates Vodafone’s converged communications strategy through in-market consolidation in Vodafone’s largest market, Germany, and in Vodafone’s Central and Eastern European markets, the Czech Republic, Hungary and Romania.

Vodafone becomes the leading next generation network (NGN) owner in Europe, with 54 million cable / fibre homes and a total NGN reach of 110 million homes and businesses, including wholesale arrangements.

Vodafone CEO Vittorio Colao said: “It represents a step change in Europe’s transition to a Gigabit Society and a transformative combination for Vodafone.”

Vodafone strategy

Vodafone said fixed line/TV services will represent 35 percent of European revenues against 29 percent prior to the transaction. Europe will represent 77 percent of the Group’s EBITDA.

The transaction is expected to generate cost and Capex synergies before integration costs of approximately €535 million per annum by the fifth year after completion, equivalent to a net present value of over €6 billion after integration costs.

These savings are similar in nature to those generated by the successful integrations of Kabel Deutschland in Germany and ONO in Spain. The principal efficiencies derive from network integration, IT/billing simplification, procurement, and consolidating overlapping functions.

There will be savings in Germany from the migration of Vodafone’s existing overlapping fixed line DSL customer base to the Unitymedia cable network.

Vodafone aims to use its brand, extensive distribution network and scale to accelerate the growth of the combined businesses. This includes the cross-selling of Liberty Global’s fixed broadband, telephony and TV offerings to Vodafone’s existing customers.

Liberty in action

Liberty will have cable television and broadband service in the U.K., Ireland, Belgium, Switzerland, Poland and Slovakia – reaching 24 million homes, accounting for 26 million video, broadband and fixed-line telephony subscribers and 6 million mobile services.

In addition, Liberty Global owns 50 percent of VodafoneZiggo, a joint venture in the Netherlands with 4 million customers subscribing to 10 million fixed-line and 5 million mobile services.

Liberty Global CEO Mike Fries said: “The transaction values our core cable operations at a double digit OCF multiple and will deliver $12.7 billion of cash proceeds to Liberty Global.”

Baburajan K