The year 2018 was a tough phase for the Indian telecom industry including network suppliers and mobile operators due to several factors.

First, India’s mobile phone customer-base touched 1,169.29 million in September 2018 from 1,167.44 million in December 2017, analysis of TRAI data indicates.

The addition of 2.15 million in 9-months of the year shows that telecom operators have also removed their in-active or loss making customers. The removal of subscribers from mobile network has resulted into complaints from some of the consumers.

Airtel indicated that it may remove 70 million customers in phases in a bid to improve its revenue and profit.

Vodafone Idea has increased its wireless subscriber base to 434.95 million in September 2018 from 409 million in December 2017.

Airtel ended the September quarter of 2108 with 343.52 million as compared with 290.11 million subscribers in December 2017.

Reliance Jio has 252.25 million in September 2018 as compare with 160.09 million in the end of 2017.

BSNL is the fourth largest telecom operator in India with a subscriber base of 113.04 million in September 2018 as against 107.91 million in December 2017.

Second, the marginal increase in mobile subscriber base is a bad news for telecom equipment makers such as Huawei, Nokia, Ericsson, ZTE, Samsung, Cisco, HPE, Juniper, IBM, among others. Most of the Capex of Airtel, Reliance Jio, Vodafone Idea and BSNL was marked towards the expansion of mobile data network across India.

Samsung Electronics and Cisco are expected to have gained from the rapid expansion of Reliance Jio’s 4G network across the country. Reliance Jio added 92 million subscribers in 9 months to its all-India 4G network. Reliance Jio does not reveal its annual Capex for rolling out mobile data network.

Third, India could not conduct spectrum auction in 2018. The current indication is that India will conduct the next round of spectrum auction in 2019-end or early-2020. India will sell 5G spectrum as well during the next spectrum auction.

Fourth, Airtel lost its dominant position as the number one operator to Vodafone Idea. Sunil Mittal, chairman of Bharti Airtel, said the company does not believe in the position. Its focus is in serving its mobile phone customers with the best quality services.

Airtel added 53.41 million subscribers mainly from its acquisitions. Airtel won several accolades for offering the best network to its customers. Airtel is also the top operator in terms of total revenue from India.

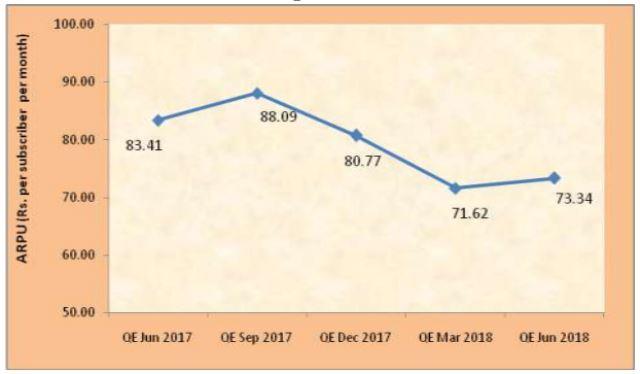

Fifth, Indian telecom operators’ ARPU – an indicator of revenue — continued to dive despite some operators started tightening their mobile tariffs. Monthly ARPU fell to Rs 73.34 in June 2018 from Rs 71.62 in March 2018 and Rs 80.77 in December 2017, according to TRAI.

Indian mobile service providers will start shifting their 2G and 3G customers to 4G network in phases. This will be one of the major developments in 2019 and will be part of the strategy to gain more in the mobile data market.

Indian mobile service providers will start shifting their 2G and 3G customers to 4G network in phases. This will be one of the major developments in 2019 and will be part of the strategy to gain more in the mobile data market.

Analyst firm Canalys said Indian smartphone market dropped 1 percent to 40.4 million in Q3 2018.

India overtook the US during the third quarter to be the second largest smartphone market, though both countries were hit by weaker seasonal performance compared with last year, said Canalys Analyst Mo Jia, based in Shanghai.

Year of Digital

COAI’s director general Rajan Mathews said the year 2018 may be called the Year of Digital. India has taken notable steps towards the roll-out of 5G and other emerging technologies such as M2M, IoT, AI, AR and VR, among other things.

Other notable things included the introduction of the National Digital Communications Policy (NDCP 2018); Supreme Court’s verdict on Aadhaar based KYC and EMF testing of telecom towers at specific sites; and mergers, acquisitions and consolidations in the industry.

Telecom infrastructure

India has more than 5 lakh mobile towers with over 20 lakh BTS. The addition of cell towers ensured improvement in voice services in several states. Test and measurement solution companies such as Anritsu, Keysight Technologies, among others, have also gained from the expansion of telecom infrastructure.

Telecom sector attracted foreign direct investment (FDI) worth $6.2 billion in 2017-18 fiscal, increasing five times from $1.3 billion in 2015-16.

COAI said India need an investment of about $100 billion to deploy infrastructure for 5G over the next 5 to 7 years. 5G’s collective economic impact on India can reach $1 trillion by 2035.

COAI demands that new spectrum bands below 6GHz should be leveraged for 5G. High frequency bands, those above 24GHz will also be needed for applications that require very high data rates.

TRAI has recommended a pan-India base price of Rs 4.92 billion per megahertz unpaired spectrum for the proposed 5G band of 3300-3600 MHz.

The country’s total licensed mobile spectrum is about 220 MHz as compared to 608 MHz in the USA and 353 MHz in the UK. COAI and GSMA are urging Indian telecom ministry to keep more cost-effective spectrum for mobile operators.

Baburajan K