Apple has achieved its best-ever performance in India due to a cheaper iPhone 11, and the innovation around its dual and triple cameras.

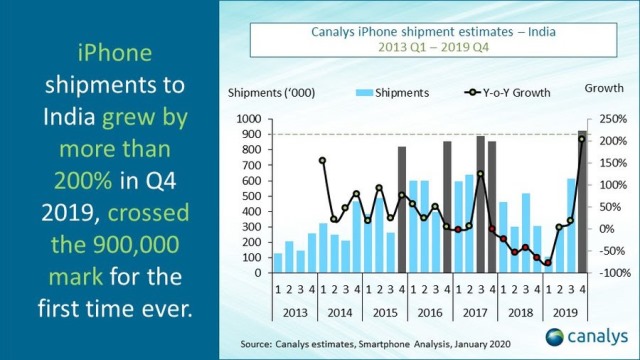

Apple shipped close to 925 thousand iPhones in Q4 2019, growing by over 200 percent annually. Its previous best performance was in Q3 2017 when it shipped 890 thousand iPhones to India, Canalys said.

Apple shipped close to 925 thousand iPhones in Q4 2019, growing by over 200 percent annually. Its previous best performance was in Q3 2017 when it shipped 890 thousand iPhones to India, Canalys said.

Apple also finished sixth, behind Oppo, its highest rank in India since Q4 2013. Apple shipped 2 million iPhones in 2019 versus 1.6 million in 2018.

Apple’s partnership with HDFC Bank made iPhones more affordable. The new iPhones have appealed not just to current iPhone users looking to upgrade, but also to value-conscious premium phone purchasers that are now presented with a formidable price-alternative to the Samsung or OnePlus flagships.

Apple CEO Tim Cook earlier today said the company achieved double-digit growth in many developed markets, including the U.S., the UK, France and Singapore. Apple grew in double digits in emerging markets led by strong performances in Brazil, Mainland China, India, Thailand, and Turkey.

“These new models are by far the best iPhones we’ve ever shipped with advance technologies and unprecedented leap in battery life to easily get through the day and our best-in-class camera experience. We have been wild with the photos customers have shared in our all-new Night Mode photo challenge this month,” Tim Cook said.

India

Indian smartphone market grew 14 percent in Q4 2019, with total shipments at 39 million units. India smartphone market grew 8 percent to 148 million smartphones in 2019.

Xiaomi led the market in Q4, with shipments rising 13 percent to 11.2 million units. Xiaomi shipped 42.9 million units for the full year, against 41 million in 2018.

Samsung held second place, but declined 7 percent to 8.1 million smartphones, and ended the year at 32.3 million units, versus 35.4 million in 2018.

Vivo’s Q4 shipments grew 69 percent and full-year shipments by 72 percent, shipping 7 million and 24.7 million units respectively.

Realme shipments reached 4.7 million units.

Oppo shipped 4.5 million unit shipments in Q4, growing by 42 percent. Oppo shipped 16.1 million smartphones, up by 44 percent from 11.2 million in 2018.

Canalys expects the Indian smartphone market to grow by 8 percent in 2020 to over 160 million units.

India’s cash-starved telcos will need a reprieve, either in the form of waivers or increased tariffs, without which telco investments into 5G will likely slow down, making it difficult for vendors to build a case for 5G smartphones.